Winners / Selection Rationale

Mitsubishi Corp. - UBS Realty Inc. Industrial Division, Industrial & Infrastructure Fund Investment Corporation

2013 13th Porter Prize Winner Real Estate Investment Trust/REIT Management

Supports the securitization of industrial real estate held by Japanese companies, with the aim of helping to revitalize the Japanese economy

Industry background

Mitsubishi Corp. - UBS Realty Inc.'s Industrial Division manages the Industrial & Infrastructure Fund Investment Corporation (hereafter, IIF), which is the first and only J-REIT that focuses on industrial and infrastructure properties, such as logistics centers, factories, R&D centers and data centers owned by companies and local governments. IIF was listed on the Tokyo Stock Exchange in October 2007.

Mitsubishi Corp. - UBS Realty Inc.'s Industrial Division manages the Industrial & Infrastructure Fund Investment Corporation (hereafter, IIF), which is the first and only J-REIT that focuses on industrial and infrastructure properties, such as logistics centers, factories, R&D centers and data centers owned by companies and local governments. IIF was listed on the Tokyo Stock Exchange in October 2007. Other J-REITs usually own residential apartments or office buildings. Some REITs might own logistics centers, but they rarely own industrial properties, such as R&D centers, data centers, and maintenance centers for airline companies, like IIF does.

When IIF purchases an industrial property from a company, it takes ownership and then leases back the property to the previous owner so that it can continue using that same property. IIF also provides maintenance services for the property being leased. After taking the ownership of a property, IIF securitizes the ownership and creates a REIT, which is sold to investors through public offerings.

Mitsubishi Corp. - UBS Realty Inc. was established in 2000 as a 51:49 joint venture between Mitsubishi Corporation and UBS AG, one of the world's largest real estate investment managers.

Unique Value Proposition

In the mission statement for IIF, Mitsubishi Corp. - UBS Realty Inc. declares that its mission is to "support Japan's economic activities by investing in social infrastructure, which forms the base for economic growth." It is very unusual for the mission statement of a REIT to mention "social value."Those companies that have sold real estate to IIF can continue their operations on the same property by paying a lease expense. This arrangement also allows them to obtain cash, which they can invest in their core business activities. If the sales price is higher than the book value, they can realize a profit from the sale of the property. They can also improve their balance sheet. The rents would remain stable, as most rent contracts offer fixed rent rates (the average rental contract period for tenant companies is longer than 13 years). Companies might be able to sell a property to an entity with a specified investment time period, but that entity might sell the property to others. In such case, the tenant faces the risk of not being able to continue using that property. In contrast, IIF is a listed REIT which is a closed-end fund without specified maturity or redemption date, allowing tenants to expect a long-term ownership by IIF and the right to continue using that property over the long term. Tenant companies can also confirm the financial stability of IIF, which affects the likelihood of continuous use, through IIF's extensive investor relations activities and the disclosure of such information as profitability, obtained properties, occupancy rates, and rental income. Tenants can also outsource non-core business activities like property maintenance because IIF provides such services as the property's owner.

IIF conducts a global offering, and has non-Japanese investors as customers. Owners of the IIF REIT units enjoy continuous dividends and capital gains (so far, the IIF REIT's price has been increasing). IIF's total return (dividends + capital gains) is one of the highest among J-REIT products. IIF's occupancy rate is extremely stable, and it also generates a consistent level of rental income. IIF's occupancy rate in January 2013 was 100%, while the average occupancy rate for residential properties was 96.6%, logistics centers was 97.2%, and offices was 95.1%. IIF's rental income in June 2013 was 97.9% of the July 2008 level, while the average rate of rental income from residential properties was 96.4%, logistics centers was 93.8%, and offices was 71.6%.

Unique Value Chain

Its value chain is very different from those of other J-REITs because the industrial properties in which it invests do not have high liquidity levels like the residential, office and retail properties in which other REITs invest. This uniqueness is reflected in its property searches, procurement activities, and operations.Procurement of properties: Mitsubishi Corp. - UBS Realty Inc. defines "continuity" and "versatility" as the property selection criteria. Because the profitability of real estate investment depends on occupancy rates and rent income, it is preferable that the property will continue being used by the previous owner. If a tenant company decides to stop using a property, ideally that space should be leased to another corporate tenant at the same rental rate (versatility). Mitsubishi Corp. - UBS Realty Inc. conducts a thorough preliminary analysis of a property prior to its acquisition. The owner company must be operating in an industry with an industry structure good enough to warrant a long-term commitment to the facility. In addition, the owner's earnings performance should be solid, and the facility should be important to the owner. In addition to an internal screening conducted by Mitsubishi Corp. - UBS Realty Inc., a third company will examine prospective property to assess its continuity and versatility, and reports containing the results of this examination are published for investors.

Because there was no market for corporate real estate in Japan in 2007 when Mitsubishi Corp. -UBS Realty Inc. created the IIF, the company had to search for potential sellers and educate them about the benefits that the securitization of real estate property provides to an owner company's management. It had to help customers understand the need for securitization. Through this process, the company creates a win-win relationship while also creating value for property sellers. This results in a negotiated transaction, not competitive bidding. Now that the securitization of real estate property has become an established practice in Japan and REITs (including the IIF) have become well known, more customers are knocking on Mitsubishi Corp. - UBS Realty Inc.'s door.

Procurement of capital: IIF finances itself through public offerings, bank loans, the selling of properties on hand, and cash in hand. Sometimes, Mitsubishi Corporation provides bridge funds. The IIF's long-term preferential debt is rated as AA (stable, as of August 6, 2013) by the Japan Credit Rating Agency, Ltd. (JCR).

Fund administration: The average rent contract period between IIF and tenants is over 13 years, and the vacancy rate has been kept below 0.1% continuously. This has resulted in a stable cash flow. Cash outflow happens when IIF conducts maintenance services on the properties. However, cash outflow is stable because IIF has tenants make arrangements for long-term maintenance plans. IIF maintains close communication with tenants, which contributes to their long-term leasing.

Marketing & sales: IIF conducts extensive investor relations activities in order to communicate the unique risk characteristics of this REIT compared with other J-REITs. It attracts investment from outside Japan by conducting a global offering, which is unique among J-REITs.

Human resources management: In contrast to other J-REITs, where people on loan from parent companies dominate the operations, Mitsubishi Corp. - UBS Realty Inc. recruits experienced professionals with specialized expertise.

Fit among Activities

The activities of Mitsubishi Corp. - UBS Realty Inc.'s Industrial Division are selected and coordinated around one key strategic choice, namely, the decision to focus on industrial real estate. The core activities are: 1) making proposals to property owning companies regarding the creation of value through corporate real estate (CRE), with the aim of purchasing those properties; 2) raising funds and managing investors; and 3) undertaking fund administration. These three core activities are handled by employees with expertise in this field. (Please refer to Mitsubishi Corp. - UBS Realty Inc. Industrial Division's activity system map, which appears at the end of this report.)Innovation that Enabled Strategy

- Unique target market, i.e., industrial real estate properties. (Since IIF's listing in 2007, no other J-REIT has invested in industrial real estate.)

- It reduces risk for fund operating companies by securitizing those properties, rather than just taking ownership and leasing back those properties. Securitization also allows for more rapid expansion in size by making financing easier.

- Application of this business concept to public real estate (PRE). IIF created a tool by which public entities can sell their real estate holdings and improve their balance sheet. (Specifically, in January 2013, IIF bought the land on which a logistics center was operating, and changed the name to the "IIF Kobe Logistics Center.")

Trade-offs

- Does not invest in office buildings, residential apartment buildings, or retail buildings.

- Does not buy from the market. Does not participate in competitive bidding.

- Does not offer private placement funds. Although a private placement fund is more flexible, Mitsubishi Corp. - UBS Realty Inc. prefers the transparency and permanence of REITs.

- Does not purchase real estate solely from its sponsor companies or any other specific pipelines.

Consistency of Strategy over Time

Mitsubishi Corp. - UBS Realty Inc.'s Industrial Division has three core consistencies.The first is its focus on investment in industrial real estate. When the Industrial Division listed IIF in October 2007, IIF had eight logistics centers and one infrastructure (worth 66 billion yen in total). However, IIF had to wait until 2010 to be able to purchase real estate through CRE strategy proposal activities. There were no precedents, and companies had difficulty accepting the Division's proposal. The company's epoch-making achievement occurred in 2010, when IIF purchased an R&D facility from Taisei Corporation. This facility was later renamed IIF Totsuka Technology Center, and was leased back to corporate tenants with a long-term fixed rental contract. This raised Japanese companies' awareness regarding IIF. Since then, IIF has been adding alternative methods, such as the securitization of newly developed properties with long-term tenants and the purchase of real estate from public entities, while maintaining its primary focus on industrial real estate.

The second core consistency is the procurement of real estate through CRE proposals. Representatives of the Industrial Division talk directly with property owners, make proposals on how to create more value from their real estate, and purchase the properties directly from the owners. The Industrial Division can thus avoid paying the premiums that often accompany competitive bids.

The third core consistency is the commitment to its own screening criteria, which are "continuity" and "versatility." Not only are these criteria applied in all cases--the Industrial Division also asks a third-party to evaluate the properties based on these criteria and publish the results.

Profitability

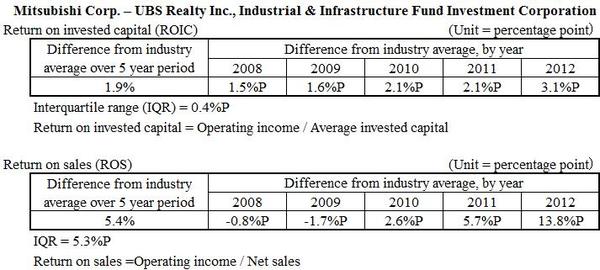

Both return on invested capital and return on sales exceed the industry average.

Activity System Map

Winners PDF

- 2013 Porter Prize Winners PDF (All of the award company in this year are published. )