Winners / Selection Rationale

Pigeon Corporation Baby and Mother Care Products Business

2016 16th Porter Prize Winner Manufacturing and sales of baby and mother care products

Pigeon focuses on products for infants from 0 to 18 months of age, who have the same needs across the globe. With the value proposition of promoting breastfeeding, Pigeon has built trust with mothers and has captured a dominant market share in nursing bottles and silicone nipples.

Pigeon is a market leader in Japan for baby care products centered on breastfeeding. The company holds the No. 1 share in the domestic market for nursing bottles and nipples (75.8% in fiscal year 2015; the same applies hereinafter), nursing bottle detergents (83.4%), training cups with nipples used for the transition from bottle to cup (73.6%), breast pads (67.0%), skincare products for babies (36.2%), and baby wipes (30.1%). As a result of the company's strong commitment to research and product innovation, Pigeon products have become known for their quality, safety and performance. Meanwhile, Pigeon works to strengthen its relationship with the mothers of newborns by organizing support activities for new mothers in hospital maternity wards. Overseas, Pigeon enjoys a high market share in China, the U.S. (under the Lansinoh brand name) and Germany (under the Lansinoh brand name).

Pigeon is a market leader in Japan for baby care products centered on breastfeeding. The company holds the No. 1 share in the domestic market for nursing bottles and nipples (75.8% in fiscal year 2015; the same applies hereinafter), nursing bottle detergents (83.4%), training cups with nipples used for the transition from bottle to cup (73.6%), breast pads (67.0%), skincare products for babies (36.2%), and baby wipes (30.1%). As a result of the company's strong commitment to research and product innovation, Pigeon products have become known for their quality, safety and performance. Meanwhile, Pigeon works to strengthen its relationship with the mothers of newborns by organizing support activities for new mothers in hospital maternity wards. Overseas, Pigeon enjoys a high market share in China, the U.S. (under the Lansinoh brand name) and Germany (under the Lansinoh brand name).

While nursing bottles are Pigeon's main product line (with a priority on R&D and sales promotion activities), the market for bottles is small. Moreover, the unit price for a nursing bottle ranges from several hundred yen (or several dollars) to two thousand yen (or 20 dollars). According to Pigeon, domestic monthly expenditures for the entire category of breastfeeding, weaning, and baby food crockery (which includes nursing bottles) came to 343 yen(*1), only 2.4% of total monthly expenditures per baby of 18,196 yen in 2014. The size of the market for nursing bottles is estimated to be 3 billion yen in Japan, 20 billion yen in the U.S., and 80 billion yen in China. In addition to the small market size, the barrier to entry into the nursing bottle market is relatively low, due largely to the fact that the materials used in production are commodities--plastic for nursing bottles and silicon rubber for nipples. With regard to other baby products, there are large markets overseas for breast pumps. A broader definition of baby care products includes strollers and infant car seats, which have more expensive price tags.

The number of births in Japan peaked at two million in 1973, and then fell to one million in 2014 (down 29,000 from the previous year). Against the backdrop of a declining birthrate, Pigeon has been aggressively expanding into overseas markets since 2000. A notable achievement is that Pigeon has succeeded in growing its business without losing its high profitability.

(*1)The categories with larger monthly expenditures per infant were: clothes and diapers (32.2%); baby formula and other foods (22.7%); outing products, furniture, beds, etc. (15.4%); breastfeeding, baby food crockery, bathing and hygiene (10.7%); toys and picture books (9.6%); and medical treatment (9.4%). (Figures compiled by Pigeon)

Unique Value Proposition

Pigeon's target customers are babies from 0 to 18 months of age and their mothers. At this age, babies everywhere experience the same process of development. They share the same intraoral structure, and make the same peristaltic tongue movements when drinking from the breast. For these reasons, nursing bottles can be sold to mothers in any country in the world regardless of the race or ethnicity without requiring localization. However, babies develop rapidly between 0 to 18 months. So, some products will have to be upgraded as the baby grows, providing more opportunities for replacement demand.

Pigeon's value proposition is to identify areas of concern in child-rearing in order to resolve them. The company's broad product line consists of nursing bottles, nipples, pacifiers and training cups--all flagship products, as well as skincare products for babies, breastfeeding-related products, baby wipes, healthcare products for babies (including nail scissors), and skincare products for mothers. Nursing bottles (bottles and nipples), account for 30% of the company's sales.

One of the biggest problems babies and mothers face is nipple confusion. Some babies do not want to drink from nursing bottles because they are used to being breastfed; they know that something is different. In other cases, some babies will not drink from the breast after getting used to drinking from nursing bottles. This happens to about 20% of all babies. Pigeon's nursing bottles have gained a favorable reputation among mothers because the nursing bottle, and especially the nipple, function in a way that is so similar to the mother's nipple that babies tend to experience less nipple confusion. The secret behind this is "the three key factors of the sucking process," which have been identified by Pigeon through its own research on infants' peristaltic tongue movements and other sucking behaviors during breastfeeding. The baby's sucking process can be broken down into the following key factors: 1) Attachment (the baby latching on to the nipple); 2) Peristaltic tongue movement (the baby's tongue moving in a wave-like motion over the nipple to suck breast milk); and 3) Swallowing (the baby swallowing the breast milk down into the esophagus, breathing at the same time as the tongue moves). Based on this finding, the company developed and launched in 2010 a new nursing bottle that features a soft peristaltic nipple with the brand name of Bonyu Jikkan (or SofTouchTM Peristaltic PLUS in overseas markets). This innovative nipple, which has an "accordion-like" section that enables it to stretch in response to the baby's peristaltic tongue movements, provides infants with a more natural feeding experience. Many mothers who are busy with breastfeeding and child-rearing choose Pigeon's high-end nursing bottles despite their higher price. The point is that mothers are willing to pay more for high-quality products that can minimize their post-purchase consumer regret (i.e. "buyers' remorse").

Pigeon's nursing bottles are often more expensive, selling at a retail price 20% to 50% higher than others on the market.

Pigeon's value proposition is to identify areas of concern in child-rearing in order to resolve them. The company's broad product line consists of nursing bottles, nipples, pacifiers and training cups--all flagship products, as well as skincare products for babies, breastfeeding-related products, baby wipes, healthcare products for babies (including nail scissors), and skincare products for mothers. Nursing bottles (bottles and nipples), account for 30% of the company's sales.

One of the biggest problems babies and mothers face is nipple confusion. Some babies do not want to drink from nursing bottles because they are used to being breastfed; they know that something is different. In other cases, some babies will not drink from the breast after getting used to drinking from nursing bottles. This happens to about 20% of all babies. Pigeon's nursing bottles have gained a favorable reputation among mothers because the nursing bottle, and especially the nipple, function in a way that is so similar to the mother's nipple that babies tend to experience less nipple confusion. The secret behind this is "the three key factors of the sucking process," which have been identified by Pigeon through its own research on infants' peristaltic tongue movements and other sucking behaviors during breastfeeding. The baby's sucking process can be broken down into the following key factors: 1) Attachment (the baby latching on to the nipple); 2) Peristaltic tongue movement (the baby's tongue moving in a wave-like motion over the nipple to suck breast milk); and 3) Swallowing (the baby swallowing the breast milk down into the esophagus, breathing at the same time as the tongue moves). Based on this finding, the company developed and launched in 2010 a new nursing bottle that features a soft peristaltic nipple with the brand name of Bonyu Jikkan (or SofTouchTM Peristaltic PLUS in overseas markets). This innovative nipple, which has an "accordion-like" section that enables it to stretch in response to the baby's peristaltic tongue movements, provides infants with a more natural feeding experience. Many mothers who are busy with breastfeeding and child-rearing choose Pigeon's high-end nursing bottles despite their higher price. The point is that mothers are willing to pay more for high-quality products that can minimize their post-purchase consumer regret (i.e. "buyers' remorse").

Pigeon's nursing bottles are often more expensive, selling at a retail price 20% to 50% higher than others on the market.

Unique Value Chain

The uniqueness of the value chain for Pigeon's Baby & Mother Care Products Business can be found in: 1) extensive research on baby-related topics; 2) marketing to raise awareness of products and build trust with new mothers in hospital maternity wards and maternity hospitals; and 3) a management control system that puts EVA (economic value added) at its center.

R&D

Pigeon differentiates its products by ensuring the superior performance of those products. Such differentiation is achieved through aggressive research and development efforts, as evidenced by the company's findings regarding babies' sucking behaviors (i.e. "The three key factors of the sucking process"). Since 2007, Pigeon has published 18 research papers on sucking and another 34 in other baby-related topics (including skincare for babies, their sleep habits, calmness, heart rate, body temperature, and the way they learn to use chop sticks). Pigeon's competitors rarely publish papers on the topic of the sucking process during breastfeeding.

An important focus of research at Pigeon has been on the development of artificial nipples suitable for use by babies born underweight or newborns a few months old who have a very weak sucking power. Based on its research, Pigeon, in cooperation with a rubber manufacturer, developed a nipple made of silicon rubber that is soft but does not collapse.

Marketing

Pigeon raises awareness of its products and builds trust with mothers by giving them the chance to experience the nursing bottles during their stay in the maternity ward. In fact, more than 80% of hospital maternity wards and maternity hospitals use Pigeon's nursing bottles.

At retail shops, Pigeon has created a "Pigeon Corner," an area that displays all of the company's products including nursing bottles and related products (such as detergents and bottle brushes), skincare products, breastfeeding-related products and pacifiers.

Pigeon organizes lectures and holds classes to reach potential customers. By holding classes 27 times a year for women approaching childbirth and hosting gatherings for working women preparing for pregnancy, Pigeon was able to communicate directly with 1,600 potential customers in 2015. The company also hosted seminars for healthcare professionals 11 times. These seminars attracted 1,200 participants.

Human resources management

In March 2014, Pigeon created "The Pigeon Way," which states its corporate philosophy, credo, mission statement, values, action principles and vision. Pigeon's corporate philosophy is "Love," which is defined as "the ability to treasure other people." Behind its philosophy is the belief, or credo, embodying its commitment to "developing products and services full of love, because only love can beget love." Yoichi Nakata, the second President of Pigeon and the person who adopted "Love" as the company's corporate philosophy in 1980, further elaborated on this credo, saying, "The Pigeon Group is a corporate entity that provides products and services for babies, children and those who need assistance. We won't be able to generate products and services full of love if we lack the spirit ourselves" (quoted from a statement he made on June 23, 1980). Through its mission statement, Pigeon pledges to "bring joy, happiness and inspiration to babies and families around the world by providing them with products and services that embody love." Through its vision, Pigeon aims "to be the baby product manufacturer most trusted by the world's babies and families, i.e. 'Global Number One.'" To achieve this ambitious goal, the company is aggressively pursuing R&D, overseas business development and M&As. Further, its action principles consist of "agility," "keeping sight of consumers," "global collaboration among competent individuals," "leadership and logical working style," and "willingness to change."

The Pigeon Way reminds employees that the spirit of love is the foundation for all the company's activities. Every six months, employees submit a report on how they are embodying the Pigeon Way. This report is used in employee performance evaluations. Some of the best reports are selected as a "Pigeon Way Story," and shared at gatherings attended by employees. These stories are also posted on the company's website.

With regard to employee training, the company realizes the need to help male employees gain a deeper understanding of the types of problems that mothers face in caring for their babies. It is now required for all male employees to take a one-month parenting leave when a baby is born. Afterward, men who have taken parenting leave need to submit a report on their parenting experiences. Their reports will be reviewed as part of their performance evaluations.

Although overseas sales account for about a half of Pigeon's total sales, overseas business operations have been very localized. As a result, Pigeon does not have many Japanese expatriates working abroad.

Management control

Pigeon selects ROE (return on equity), ROIC (return on invested capital), CCC (cash conversion cycle) and PVA (Pigeon Value Added, or Pigeon's version of Economic Value Added) as its key performance indicators (KPIs). Through the provision of employee training, Pigeon helps its employees gain a better understanding of these KPIs, which are used by the business unit for operational performance evaluations and business planning. Since 2014, the performance of all the business divisions has been evaluated using PVA as the key performance indicator. The company strongly encourages all its employees to think of how to generate a return (or profit) that exceeds the cost of capital.

R&D

Pigeon differentiates its products by ensuring the superior performance of those products. Such differentiation is achieved through aggressive research and development efforts, as evidenced by the company's findings regarding babies' sucking behaviors (i.e. "The three key factors of the sucking process"). Since 2007, Pigeon has published 18 research papers on sucking and another 34 in other baby-related topics (including skincare for babies, their sleep habits, calmness, heart rate, body temperature, and the way they learn to use chop sticks). Pigeon's competitors rarely publish papers on the topic of the sucking process during breastfeeding.

An important focus of research at Pigeon has been on the development of artificial nipples suitable for use by babies born underweight or newborns a few months old who have a very weak sucking power. Based on its research, Pigeon, in cooperation with a rubber manufacturer, developed a nipple made of silicon rubber that is soft but does not collapse.

Marketing

Pigeon raises awareness of its products and builds trust with mothers by giving them the chance to experience the nursing bottles during their stay in the maternity ward. In fact, more than 80% of hospital maternity wards and maternity hospitals use Pigeon's nursing bottles.

At retail shops, Pigeon has created a "Pigeon Corner," an area that displays all of the company's products including nursing bottles and related products (such as detergents and bottle brushes), skincare products, breastfeeding-related products and pacifiers.

Pigeon organizes lectures and holds classes to reach potential customers. By holding classes 27 times a year for women approaching childbirth and hosting gatherings for working women preparing for pregnancy, Pigeon was able to communicate directly with 1,600 potential customers in 2015. The company also hosted seminars for healthcare professionals 11 times. These seminars attracted 1,200 participants.

Human resources management

In March 2014, Pigeon created "The Pigeon Way," which states its corporate philosophy, credo, mission statement, values, action principles and vision. Pigeon's corporate philosophy is "Love," which is defined as "the ability to treasure other people." Behind its philosophy is the belief, or credo, embodying its commitment to "developing products and services full of love, because only love can beget love." Yoichi Nakata, the second President of Pigeon and the person who adopted "Love" as the company's corporate philosophy in 1980, further elaborated on this credo, saying, "The Pigeon Group is a corporate entity that provides products and services for babies, children and those who need assistance. We won't be able to generate products and services full of love if we lack the spirit ourselves" (quoted from a statement he made on June 23, 1980). Through its mission statement, Pigeon pledges to "bring joy, happiness and inspiration to babies and families around the world by providing them with products and services that embody love." Through its vision, Pigeon aims "to be the baby product manufacturer most trusted by the world's babies and families, i.e. 'Global Number One.'" To achieve this ambitious goal, the company is aggressively pursuing R&D, overseas business development and M&As. Further, its action principles consist of "agility," "keeping sight of consumers," "global collaboration among competent individuals," "leadership and logical working style," and "willingness to change."

The Pigeon Way reminds employees that the spirit of love is the foundation for all the company's activities. Every six months, employees submit a report on how they are embodying the Pigeon Way. This report is used in employee performance evaluations. Some of the best reports are selected as a "Pigeon Way Story," and shared at gatherings attended by employees. These stories are also posted on the company's website.

With regard to employee training, the company realizes the need to help male employees gain a deeper understanding of the types of problems that mothers face in caring for their babies. It is now required for all male employees to take a one-month parenting leave when a baby is born. Afterward, men who have taken parenting leave need to submit a report on their parenting experiences. Their reports will be reviewed as part of their performance evaluations.

Although overseas sales account for about a half of Pigeon's total sales, overseas business operations have been very localized. As a result, Pigeon does not have many Japanese expatriates working abroad.

Management control

Pigeon selects ROE (return on equity), ROIC (return on invested capital), CCC (cash conversion cycle) and PVA (Pigeon Value Added, or Pigeon's version of Economic Value Added) as its key performance indicators (KPIs). Through the provision of employee training, Pigeon helps its employees gain a better understanding of these KPIs, which are used by the business unit for operational performance evaluations and business planning. Since 2014, the performance of all the business divisions has been evaluated using PVA as the key performance indicator. The company strongly encourages all its employees to think of how to generate a return (or profit) that exceeds the cost of capital.

Fit among Activities

In Pigeon, activities are selected and coordinated in order to realize the company's value proposition, which is to find solutions for the concerns of babies aged 0 to 18 months and their mothers. Pigeon's commitment to R&D and the support it provides to hospital maternity wards and maternity hospitals is unmatched by any other company. These activities help Pigeon to raise awareness regarding its products and gain the trust of mothers, while continuing to develop its broad product line, which is carried in retail shops. These activities have a good fit, and as a whole make for a consistent system. (Please refer to the "Activity System Map of Baby & Mother Care Products Business of Pigeon Corporation," which appears at the end of this report.)

Innovation that Enabled Strategy

- Focuses on babies aged 0 to 18 months. Their needs and their mothers' needs are universally the same, regardless of race and ethnicity, which makes for a truly global market.

- Has identified "the three key factors of the sucking process."

Trade-offs

- Does not target babies older than 18 months. After 18 months, babies start developing a sense of self. They start talking, and begin developing personal preferences. They become sensitive to cultural influences, customs and society. Their previously universal needs begin to change, gradually differing across countries and cultures. They are no longer satisfied with globally standardized products.

- Does not expand its business domain into powdered milk. Although powdered milk is a product that is highly compatible with nursing bottles, and the size of the market for powdered milk is much bigger than that for nursing bottles, powdered milk does not fit with Pigeon's stance on supporting breastfeeding.

- Does not expand its business domain into baby clothes. Although the size of the market for baby clothes is large, Pigeon would not be able to achieve differentiation through R&D. Also, customer needs differ from country to country.

Consistency of Strategy over Time

Pigeon was established 60 years ago, in 1956, in line with the founder's belief that "baby products brighten a country's future". The company has always been centered on baby care products. Pigeon has been consistently and earnestly addressing the needs of mothers and infants since its establishment, always providing high-quality products based on research.

Pigeon's products enjoy a competitive advantage in the retail channel. The company has helped consumers develop an affinity for Pigeon's products while simultaneously gaining the trust of mothers by getting hospital maternity wards and maternity hospitals to use Pigeon nursing bottles and other products. This strategy dates back to 1959, when Pigeon's nursing bottles received a commendation from the Japan Red Cross. Recognition by the Japan Red Cross spurred the widespread use of Pigeon nursing bottles in hospital maternity wards and maternity hospitals. Now, more than 80% of hospital maternity wards and maternity hospitals in Japan use Pigeon's nursing bottles. This has helped Pigeon products get better placement on shelves in retail stores and has led to other sales promotion opportunities, which have enabled Pigeon to establish its leadership in the B-to-C segment.

Pigeon started selling nursing bottles in China in 2002. Following the adoption of the World Health Organization's International Code of Marketing Breast-milk Substitutes in China, companies were prohibited from conducting sales promotion activities for nursing bottles in hospital maternity wards and maternity hospitals. (Such promotional activities were still permitted in Japan.) Pigeon shifted its strategic focus from selling nursing bottles to providing support for breastfeeding. Pigeon received permission from Chinese authorities to work in hospital maternity wards and maternity hospitals as a special advisor on breastfeeding, and this project was carried out in collaboration with the Chinese government officials in charge of health and welfare. In the largest hospitals in each province, Pigeon opened consultation rooms for advising mothers on childcare and breastfeeding. Pigeon's employees were assigned to these consultation rooms, where they acted as consultants. In the second-and third-largest hospitals, Pigeon dispatched childcare and breastfeeding advisors to these hospitals. They conducted seminars for nurses, training them so that they could advise mothers about breastfeeding. These advisors also assisted in the classes held at hospitals for new mothers. At these hospitals, Pigeon has been able to raise brand awareness by displaying its products and distributing posters that explain about the benefits of breastfeeding (and prominently feature the Pigeon logo). At retail stores in China, Pigeon conducts the same kind of sales promotion activities that it implements in Japan. For example, Pigeon encourages retail stores in China to create special corners for Pigeon products, and now, 3,500 retail stores in the country have set up corners for Pigeon products.

Pigeon's corporate strategy-to develop a broad product line centered on nursing bottles, while simultaneously raising product awareness and gaining the trust of mothers who have just given birth during their hospital stay-is the same in Japan and China. Pigeon is considering applying this same approach in other overseas markets that are expected to grow in the future (specifically, Singapore, Indonesia, Russia and India, among others).

In 2004, Pigeon acquired Lansinoh Laboratories, headquartered in the U.S., and made it a wholly owned subsidiary. Lansinoh's nipple care cream has established a strong reputation for being "a life saver." Leveraging the high level of trust among customers regarding the performance and quality of Lansinoh products, Pigeon has since introduced its breast pads, breast milk bags, and breast pumps under the Lansinoh brand. Since 2014, Pigeon has launched a full-scale marketing campaign for nursing bottles by sticking to its policy of supporting breastfeeding.

Since 2010, Pigeon has completed two M&A deals to expand its business beyond Lansinoh in the U.S. and European markets. Specifically, in 2010, Lansinoh acquired the mOmma business, which sells a variety of baby care products in Europe. This business was acquired from Baby Solutions SA of Switzerland and Baby Solutions Italia Srl. of Italy. The mOmma business has a competitive advantage in nursing bottles and drinking cups that feature a distinctive sense of design. To mOmma's strength in design Pigeon adds functional performance. In 2011, Pigeon acquired HealthQuest of the UK, which operates its business mainly in Europe with a line-up of "Earth Friendly Baby" brand organic products and natural skincare products. The Earth Friendly Baby brand products have a reputation among mothers for being gentle on a baby's skin.

The strategy of product differentiation through aggressive R&D has been applied with consistency to the company's line of baby strollers. A baby stroller is an expensive purchase for any user; consequently, its product life tends to be longer. Pigeon provides baby strollers for infants ranging from 1 month to 36 months (beyond the usual cut-off age of 18 months employed by its other business lines). The company focuses on a type of stroller ("A-type strollers") that has a flat bed for carrying newborns older than 1 month. For strollers, Pigeon achieves differentiation by keeping the focus on the babies themselves, whereas other companies make the ease-of-use for mothers the main selling point. This baby-centric attitude is consistent with the company's approach to nursing bottles. Through a joint research project with Tokyo Institute of Technology, Pigeon has discovered that when a stroller fails to make it over a step and suddenly halts, the baby in the stroller receives a strong jolt that is five times stronger than the shock a driver receives when suddenly jamming on the car brakes. Based on this finding, in 2015 Pigeon developed its high-end "Runfee" baby stroller with big single tires, which make it easier to get over steps and reduce the risk of bumping on the steps. With this product, Pigeon has been able to increase its share in the stroller market from 2% to 12%, thereby gaining the third-largest share in the market.

Pigeon's products enjoy a competitive advantage in the retail channel. The company has helped consumers develop an affinity for Pigeon's products while simultaneously gaining the trust of mothers by getting hospital maternity wards and maternity hospitals to use Pigeon nursing bottles and other products. This strategy dates back to 1959, when Pigeon's nursing bottles received a commendation from the Japan Red Cross. Recognition by the Japan Red Cross spurred the widespread use of Pigeon nursing bottles in hospital maternity wards and maternity hospitals. Now, more than 80% of hospital maternity wards and maternity hospitals in Japan use Pigeon's nursing bottles. This has helped Pigeon products get better placement on shelves in retail stores and has led to other sales promotion opportunities, which have enabled Pigeon to establish its leadership in the B-to-C segment.

Pigeon started selling nursing bottles in China in 2002. Following the adoption of the World Health Organization's International Code of Marketing Breast-milk Substitutes in China, companies were prohibited from conducting sales promotion activities for nursing bottles in hospital maternity wards and maternity hospitals. (Such promotional activities were still permitted in Japan.) Pigeon shifted its strategic focus from selling nursing bottles to providing support for breastfeeding. Pigeon received permission from Chinese authorities to work in hospital maternity wards and maternity hospitals as a special advisor on breastfeeding, and this project was carried out in collaboration with the Chinese government officials in charge of health and welfare. In the largest hospitals in each province, Pigeon opened consultation rooms for advising mothers on childcare and breastfeeding. Pigeon's employees were assigned to these consultation rooms, where they acted as consultants. In the second-and third-largest hospitals, Pigeon dispatched childcare and breastfeeding advisors to these hospitals. They conducted seminars for nurses, training them so that they could advise mothers about breastfeeding. These advisors also assisted in the classes held at hospitals for new mothers. At these hospitals, Pigeon has been able to raise brand awareness by displaying its products and distributing posters that explain about the benefits of breastfeeding (and prominently feature the Pigeon logo). At retail stores in China, Pigeon conducts the same kind of sales promotion activities that it implements in Japan. For example, Pigeon encourages retail stores in China to create special corners for Pigeon products, and now, 3,500 retail stores in the country have set up corners for Pigeon products.

Pigeon's corporate strategy-to develop a broad product line centered on nursing bottles, while simultaneously raising product awareness and gaining the trust of mothers who have just given birth during their hospital stay-is the same in Japan and China. Pigeon is considering applying this same approach in other overseas markets that are expected to grow in the future (specifically, Singapore, Indonesia, Russia and India, among others).

In 2004, Pigeon acquired Lansinoh Laboratories, headquartered in the U.S., and made it a wholly owned subsidiary. Lansinoh's nipple care cream has established a strong reputation for being "a life saver." Leveraging the high level of trust among customers regarding the performance and quality of Lansinoh products, Pigeon has since introduced its breast pads, breast milk bags, and breast pumps under the Lansinoh brand. Since 2014, Pigeon has launched a full-scale marketing campaign for nursing bottles by sticking to its policy of supporting breastfeeding.

Since 2010, Pigeon has completed two M&A deals to expand its business beyond Lansinoh in the U.S. and European markets. Specifically, in 2010, Lansinoh acquired the mOmma business, which sells a variety of baby care products in Europe. This business was acquired from Baby Solutions SA of Switzerland and Baby Solutions Italia Srl. of Italy. The mOmma business has a competitive advantage in nursing bottles and drinking cups that feature a distinctive sense of design. To mOmma's strength in design Pigeon adds functional performance. In 2011, Pigeon acquired HealthQuest of the UK, which operates its business mainly in Europe with a line-up of "Earth Friendly Baby" brand organic products and natural skincare products. The Earth Friendly Baby brand products have a reputation among mothers for being gentle on a baby's skin.

The strategy of product differentiation through aggressive R&D has been applied with consistency to the company's line of baby strollers. A baby stroller is an expensive purchase for any user; consequently, its product life tends to be longer. Pigeon provides baby strollers for infants ranging from 1 month to 36 months (beyond the usual cut-off age of 18 months employed by its other business lines). The company focuses on a type of stroller ("A-type strollers") that has a flat bed for carrying newborns older than 1 month. For strollers, Pigeon achieves differentiation by keeping the focus on the babies themselves, whereas other companies make the ease-of-use for mothers the main selling point. This baby-centric attitude is consistent with the company's approach to nursing bottles. Through a joint research project with Tokyo Institute of Technology, Pigeon has discovered that when a stroller fails to make it over a step and suddenly halts, the baby in the stroller receives a strong jolt that is five times stronger than the shock a driver receives when suddenly jamming on the car brakes. Based on this finding, in 2015 Pigeon developed its high-end "Runfee" baby stroller with big single tires, which make it easier to get over steps and reduce the risk of bumping on the steps. With this product, Pigeon has been able to increase its share in the stroller market from 2% to 12%, thereby gaining the third-largest share in the market.

Profitability

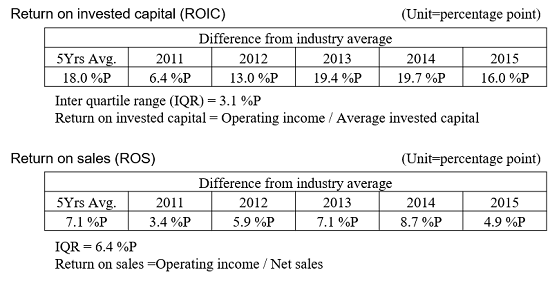

Both the return on invested capital and the return on sales have exceeded the industry average by a wide margin. (Profitability analysis was conducted with the support of PwC Japan.)

Activity System Map

Winners PDF

- 2016 Porter Prize Winners PDF (All of the award company in this year are published. )