Winners / Selection Rationale

Marui Group Co., Ltd. Card Business

2016 16th Porter Prize Winner Credit card business

Marui manages its Credit Card Services business under a unique business model, merging retailing and credit card operations. This approach, which encompasses both operations, has enabled the creation of a simple, stress-free card application and issuance process. Under its policy to “build creditability together with customers,” Marui Group has developed a strong base of young customers (predominantly in their 20s and 30s), who are more likely than older cardholders to use revolving credit and installment payments.

Marui Group offers credit card services under the EPOS Card brand name. The EPOS Card, a multipurpose card that can be used both inside and outside Marui stores, has 6.13 million cardholders, with a transaction volume of 1.465 trillion yen. The Credit Card business is a core business, with operating profit accounting for 75% of Marui Group's total operating profit in fiscal year 2015.

Marui Group offers credit card services under the EPOS Card brand name. The EPOS Card, a multipurpose card that can be used both inside and outside Marui stores, has 6.13 million cardholders, with a transaction volume of 1.465 trillion yen. The Credit Card business is a core business, with operating profit accounting for 75% of Marui Group's total operating profit in fiscal year 2015.In terms of the number of cardholders, the EPOS Card is ranked 11th in the industry, far behind the leader, Aeon Financial Service, with 25.88 million cardholders. Next is Credit Saison, with 25.61 million cardholders, followed by Sumitomo Mitsui Card, Mitsubishi UFJ Nicos (Mitsubishi UFJ Financial Group), Cedyna Financial Corp. (Sumitomo Mitsui Financial Group), NTT Docomo, Toyota Finance, Orient Corporation, JACCS (Mitsubishi UFJ Financial Group), and Life Card. 1

Marui Group was able to realize large-scale enrollment and widespread use of the EPOS Card while simultaneously lowering customer acquisition costs by having the sales staff of retail stores recommend the card to customers while they are shopping in the store. Customers are able to complete the application process when paying for their purchases. A credit card equipped with an IC chip (not a temporary card) is issued on-the-spot in stores in as little as 20 minutes. Marui Group does not issue separate cards for its collaborators. Thus, the holders of this one credit card can enjoy the cardholder benefits offered by any of the collaboration partners.

1Yano Research Institute, Credit Card Market 2016 (16 Nenban Credit Card Shijou no Jittai to Tenbou)

Unique Value Proposition

Marui Group has positioned its credit card as "the customer's first card, to be used for many years." Accordingly, Marui Group's target customers are young people with a strong appetite for spending, who will be cardholders for a long time. Individuals who turn 18 will begin earning a living, or, as students, will start working at part-time jobs. Along with access to disposable income comes the desire to do some shopping.

The first value that the EPOS Card provides is "building creditability together with customers." This is the credit philosophy of Marui Group. The company sets a much lower credit limit for new cardholders. This enables Marui Group to issue credit cards to any customer over the age of 18. After taking into account each cardholder's usage history (specifically, the account transaction volume and late payments), Marui Group may gradually raise the credit limit. A higher credit limit that is based on usage history will simultaneously improve customer convenience and help Marui Group to control credit risk. Marui Group operates Gold Cards in the same manner, and this is the practice that sets it apart from other companies, which set a higher standard based on level of annual income. Marui Group will invite cardholders to switch to Gold Cards after reviewing their transaction and payment histories. The company is willing to approve Gold Cards for young cardholders who would not normally qualify for the Gold Cards of other companies because the determining factor is usually annual income. For many cardholders, the EPOS Card is their first credit card, and the EPOS Gold Card is their very first Gold Card. Although holders of Platinum and Gold Cards make up 21% of all EPOS cardholders, their transaction volume accounts for 60% of total transactions. Furthermore, the transaction volume per cardholder of the EPOS Gold Card was triple the transaction volume of holders of ordinary credit cards in fiscal year 2015.

The second value Marui Group creates for its customers is the ease of card issuance and usage. From the beginning customers find out about additional perks associated with the EPOS Card (i.e. shopping points and sales promotions) because members of the store's staff explain such details when encouraging customers to become cardholders. All application documentation is completed on-the-spot, using a tablet device, and customers receive credit cards equipped with IC chips (in as little as 20 minutes 2 ), eliminating the need to wait at home for the delivery of registered mail on a later date. Customers can easily register a bank account from which credit card payments will be made, simply by swiping their bank ATM card at the time of application. The issuance of a proper credit card rather than a temporary card contributes to the higher usage rate. (Marui Group has experienced a 10% increase in card usage just by issuing the card on-the-spot in its retail stores, instead of having the card delivered a few days later by the postal service.) More than 70% of new cardholders in 2015 signed up for the card in one of the Marui Group's retail stores. (Marui Group operates 28 retail stores, including Marui department stores and MODI shopping centers). About 10% of new cardholders apply for the card at the shopping centers of collaboration partners, where Marui Group maintains an EPOS Card Counter. The sales staff of tenant shops encourage customers to apply for the card, and at the EPOS Card Counter, members of Marui Group apply using tablet devices. Customers receive the credit card right away, and register the card on the EPOS Card website.

The application process for switching over to a Gold Card can also be completed on-the-spot, with the customer receiving an EPOS Gold Card in about 5 minutes. This change has resulted in a 100% increase in the total number of Gold Cards issued. In 2015, 50% of all newly issued EPOS Gold Cards were issued on-the-spot.

Registering the new card on the EPOS Card website is also a quick and easy process. Registration can be done on the same tablet device used for making the initial credit card application.

This has resulted in the higher usage of the revolving credit payment option. Cardholders tend to favor a one-time, lump-sum settlement of the bill when paying for their purchase inside a retail store. It is often the case that customers will switch to a revolving credit payment format later on (an option available on the website). At the EPOS Card website, cardholders can confirm the amount of their credit card purchases, and they can also receive notifications about any sales promotions. (Such sales promotions also contribute to the active use of the credit card.) Seventy-five percent of EPOS cardholders register on the website. This figure is much higher than the industry average of 25% (according to Marui Group). Holders of Gold Cards tend to use the revolving credit payment option as often as ordinary cardholders.

Prepayment of a revolving credit payment before the end of the specified period is easy by visiting an EPOS Card center, or using the Marui Group's ATM machines, bank ATMs, and convenience store ATMs.

The third value that Marui Group creates through its credit card business is the provision of additional services. Marui Group offers shopping-point services, special sales events exclusively for cardholders at Marui Group's retail stores four times a year, and promotional sales campaigns offered for a limited time only (such promotional campaigns are also provided by other credit card operators). What is unique with Marui Group is that existing cardholders can take advantage of benefits offered by Marui Group's new collaboration partners (such as shopping malls and other companies), without having to apply for a different card. This is because Marui Group does not offer a new card for a specific collaboration. (There is a common practice among many industry players to issue a credit card limited to a specific collaboration, and the benefits are available only to holders of that credit card.) As of the end of March 2016, the EPOS Card had 7 collaborating shopping centers and 13 companies. All communications to cardholders are channeled through the EPOS Card.

The practice of sharing the same card, as described above, provides value to collaborators too. By becoming a collaborator, the new participating partner can reach 6.13 million EPOS cardholders.

The EPOS Gold Card offers expanded additional services. Through the "Specified (Shopping) Point Up Service," the holder of the Gold Card selects three collaborators and registers with these collaborators on the website. Whenever a customer makes a payment to any of these collaborators using an EPOS Card, that customer can receive three times the usual amount of shopping points. Collaborators include service providers, such as Tokyo Gas and JR East (East Japan Railway Company). Not only does this help position the EPOS Card as a main card for customers, the higher switching costs make customers less inclined to abandon the card.

The fourth value created is the provision of a credit card for which customers will develop an attachment. A credit card with the standard design is available to customers free of charge. Marui Group also offers cards in 74 different designs for an additional charge of 500 yen, and customers can choose their favorite design. Some designs have been created in collaboration with game content developing companies, with whom Marui Group hosted 41 events in 2015. These events attracted 4,100 new cardholders. About 80% percent of the holders of specially designed cards are younger than 40. The transaction volume of these cards at affiliated stores is 2.7 times, and the usage rate of revolving credit payments is 3.3 times the usage rate of ordinary cardholders. As mentioned above, holders of the specially designed cards can enjoy the same additional services provided by collaboration partners, just like ordinary cardholders.

The annual card membership fee is free for the lifetime of ordinary cardholders and the holders of Gold Cards when the cardholder is invited. The fee for a Platinum Card is 20,000 yen per year.

2 Marui Group has a patent on the on-site issuance of credit cards with IC chips.

The first value that the EPOS Card provides is "building creditability together with customers." This is the credit philosophy of Marui Group. The company sets a much lower credit limit for new cardholders. This enables Marui Group to issue credit cards to any customer over the age of 18. After taking into account each cardholder's usage history (specifically, the account transaction volume and late payments), Marui Group may gradually raise the credit limit. A higher credit limit that is based on usage history will simultaneously improve customer convenience and help Marui Group to control credit risk. Marui Group operates Gold Cards in the same manner, and this is the practice that sets it apart from other companies, which set a higher standard based on level of annual income. Marui Group will invite cardholders to switch to Gold Cards after reviewing their transaction and payment histories. The company is willing to approve Gold Cards for young cardholders who would not normally qualify for the Gold Cards of other companies because the determining factor is usually annual income. For many cardholders, the EPOS Card is their first credit card, and the EPOS Gold Card is their very first Gold Card. Although holders of Platinum and Gold Cards make up 21% of all EPOS cardholders, their transaction volume accounts for 60% of total transactions. Furthermore, the transaction volume per cardholder of the EPOS Gold Card was triple the transaction volume of holders of ordinary credit cards in fiscal year 2015.

The second value Marui Group creates for its customers is the ease of card issuance and usage. From the beginning customers find out about additional perks associated with the EPOS Card (i.e. shopping points and sales promotions) because members of the store's staff explain such details when encouraging customers to become cardholders. All application documentation is completed on-the-spot, using a tablet device, and customers receive credit cards equipped with IC chips (in as little as 20 minutes 2 ), eliminating the need to wait at home for the delivery of registered mail on a later date. Customers can easily register a bank account from which credit card payments will be made, simply by swiping their bank ATM card at the time of application. The issuance of a proper credit card rather than a temporary card contributes to the higher usage rate. (Marui Group has experienced a 10% increase in card usage just by issuing the card on-the-spot in its retail stores, instead of having the card delivered a few days later by the postal service.) More than 70% of new cardholders in 2015 signed up for the card in one of the Marui Group's retail stores. (Marui Group operates 28 retail stores, including Marui department stores and MODI shopping centers). About 10% of new cardholders apply for the card at the shopping centers of collaboration partners, where Marui Group maintains an EPOS Card Counter. The sales staff of tenant shops encourage customers to apply for the card, and at the EPOS Card Counter, members of Marui Group apply using tablet devices. Customers receive the credit card right away, and register the card on the EPOS Card website.

The application process for switching over to a Gold Card can also be completed on-the-spot, with the customer receiving an EPOS Gold Card in about 5 minutes. This change has resulted in a 100% increase in the total number of Gold Cards issued. In 2015, 50% of all newly issued EPOS Gold Cards were issued on-the-spot.

Registering the new card on the EPOS Card website is also a quick and easy process. Registration can be done on the same tablet device used for making the initial credit card application.

This has resulted in the higher usage of the revolving credit payment option. Cardholders tend to favor a one-time, lump-sum settlement of the bill when paying for their purchase inside a retail store. It is often the case that customers will switch to a revolving credit payment format later on (an option available on the website). At the EPOS Card website, cardholders can confirm the amount of their credit card purchases, and they can also receive notifications about any sales promotions. (Such sales promotions also contribute to the active use of the credit card.) Seventy-five percent of EPOS cardholders register on the website. This figure is much higher than the industry average of 25% (according to Marui Group). Holders of Gold Cards tend to use the revolving credit payment option as often as ordinary cardholders.

Prepayment of a revolving credit payment before the end of the specified period is easy by visiting an EPOS Card center, or using the Marui Group's ATM machines, bank ATMs, and convenience store ATMs.

The third value that Marui Group creates through its credit card business is the provision of additional services. Marui Group offers shopping-point services, special sales events exclusively for cardholders at Marui Group's retail stores four times a year, and promotional sales campaigns offered for a limited time only (such promotional campaigns are also provided by other credit card operators). What is unique with Marui Group is that existing cardholders can take advantage of benefits offered by Marui Group's new collaboration partners (such as shopping malls and other companies), without having to apply for a different card. This is because Marui Group does not offer a new card for a specific collaboration. (There is a common practice among many industry players to issue a credit card limited to a specific collaboration, and the benefits are available only to holders of that credit card.) As of the end of March 2016, the EPOS Card had 7 collaborating shopping centers and 13 companies. All communications to cardholders are channeled through the EPOS Card.

The practice of sharing the same card, as described above, provides value to collaborators too. By becoming a collaborator, the new participating partner can reach 6.13 million EPOS cardholders.

The EPOS Gold Card offers expanded additional services. Through the "Specified (Shopping) Point Up Service," the holder of the Gold Card selects three collaborators and registers with these collaborators on the website. Whenever a customer makes a payment to any of these collaborators using an EPOS Card, that customer can receive three times the usual amount of shopping points. Collaborators include service providers, such as Tokyo Gas and JR East (East Japan Railway Company). Not only does this help position the EPOS Card as a main card for customers, the higher switching costs make customers less inclined to abandon the card.

The fourth value created is the provision of a credit card for which customers will develop an attachment. A credit card with the standard design is available to customers free of charge. Marui Group also offers cards in 74 different designs for an additional charge of 500 yen, and customers can choose their favorite design. Some designs have been created in collaboration with game content developing companies, with whom Marui Group hosted 41 events in 2015. These events attracted 4,100 new cardholders. About 80% percent of the holders of specially designed cards are younger than 40. The transaction volume of these cards at affiliated stores is 2.7 times, and the usage rate of revolving credit payments is 3.3 times the usage rate of ordinary cardholders. As mentioned above, holders of the specially designed cards can enjoy the same additional services provided by collaboration partners, just like ordinary cardholders.

The annual card membership fee is free for the lifetime of ordinary cardholders and the holders of Gold Cards when the cardholder is invited. The fee for a Platinum Card is 20,000 yen per year.

2 Marui Group has a patent on the on-site issuance of credit cards with IC chips.

Unique Value Chain

Marui Group Credit Card Division's value chain has its uniqueness in its aggressive new cardholder acquisition program, credit policy, IT system development, and human resource (HR) management.

Cardholder acquisition

At the 28 retail stores owned by the Marui Group (including Marui Department Stores and MODI shopping centers), the sales staff at these retail stores encourage shopping customers to become credit card members. Sales staff explain to shoppers the benefits of the credit card. Through this face-to-face interaction, customers gain a better understanding of the card's benefits, and they become cardholders. Credit card application and registration of the card on the EPOS website can be done using a tablet device. A credit card with an IC chip for enhanced security can be issued to the customer in as little as 20 minutes. Promoting the credit card to shopping customers is one of the top responsibilities of the store's sales staff. Each sales staff member in Marui Group retail stores is responsible for improving the cardholder acquisition process. The sales staff members are encouraged to apply ingenuity, going beyond the dictates of the standards manual. The sales staff of tenant shops are not Marui Group's employees. Therefore, members of the Marui Group Credit Card Division explain to the sales staff of tenant shops the importance of participating in the card membership subscription program. Marui Group's sales staff also work to develop a strong relationship with the sales staff of tenant shops by offering advice on ways to improve the store's operation, drawing on their own shop management experience. At Marui Group's retail stores, performance goals are set for the issuance of new credit cards (goals for both individuals and the entire sales floor). In order to achieve the performance goal set for the sales floor, cooperation from tenant shops is indispensable. The total number of customers who visited Marui Group's stores was 200 million in 2015.

Marui Group develops shopping centers outside of the group. Inside these shopping centers, Marui Group installs card centers; service and manufacturing companies that collaborate in sales promotion activities; and animation and game developing companies, which collaborate in the design of specialty cards and organize events.

At the shopping centers not owned by Marui Group, Marui employees are assigned to work at the credit card centers. These individuals have experience providing support to the sales staff of the tenant shops inside Marui Group's retail stores. They explain how the card will benefit tenant shops, and provide tenant shop sales staff with an effective sales pitch for the EPOS Card. In shopping centers that house the credit card centers of several competitors, the aggressive promotion of the EPOS Card by the tenant store staff is crucial for the successful acquisition of new cardholders.

Marketing

In order to understand customer needs, Marui Group puts an emphasis on direct communication with customers, in addition to utilizing web-based surveys. In the case of the Hakata Marui Department Store, which opened in April 2016, Marui collected feedback from 800 customers when it invited the submission of original designs for a credit card to be made available only at Hakata Marui. A design was selected based on the results of customer surveys, and the new card was issued. In the first two months after the Hakata Marui opened, about 20,000 cards had been issued. This is a record for Marui Group, and 64% of new cardholders selected the credit card featuring the Hakata original design. When Marui developed an official smart phone application for the EPOS Card, it collected feedback from customers regarding a selection of functions and screen designs. Marui Group values marketing activities that involve its customers. Such activities, known as "co-creation activities," embody Marui Group's credit philosophy, which emphasizes its commitment to "building creditability together with customers." The company's history attests to the effectiveness of its credit policy.

Credit philosophy

The credit limit for the EPOS Card is determined following a review of each customer's card usage history, which takes into account transaction amounts and late payments, in addition to annual income.

Group-wide Human Resources Management

Marui Group has only one group-wide human resource (HR) management system, which makes it easy to transfer an employee between specific functions, assignments, or even Group companies. As a result, the majority of Marui Goup's 6,000 employees have experience working in retailing operations. Many staff members of the credit card business had been transferred in from retailing operations. This has contributed to the development of retail-friendly card-issuance operations. In the four years from April 2012 to April 2016, 1,500 employees, (or 25% of total employees) had been transferred to positions outside of their business units.

IT System Development

Since issuing its first credit card in 1960, Marui Group has been undertaking the in-house development and management of its own IT system, and in the process Marui has accumulated much know-how. On top of this, most of the employees involved in the system development and management functions have experience in both retailing operations and the issuing of credit cards in retail stores. They understand the situation, can identify a problem, and develop a list of requirements for solving that problem in a shorter time. They complete more than 100 projects a year, and have made possible: 1) the on-site issuance of credit cards with IC chips; 2) on-site membership registration at the EPOS Card website; and 3) the on-site switch to a Gold Card. When a customer who qualifies for a Gold Card checks out with a cashier, a message appears on the cash register. After reading this message, the cashier recommends that the customer switch to a Gold Card. The IT system for the issuance of Gold Cards has been developed based on the IT system for the on-site issuance of ordinary credit cards.

In-house development and management of Marui Group's IT system reduces the risk of divulgence and misappropriation of data because the management of information is undertaken internally. For its in-house efforts to prevent the unauthorized use of credit cards, Marui Group was awarded the VISA Champion Security Award in the credit card issuers' category at the VISA Security Summit 2015, held in May 2015.

Cardholder acquisition

At the 28 retail stores owned by the Marui Group (including Marui Department Stores and MODI shopping centers), the sales staff at these retail stores encourage shopping customers to become credit card members. Sales staff explain to shoppers the benefits of the credit card. Through this face-to-face interaction, customers gain a better understanding of the card's benefits, and they become cardholders. Credit card application and registration of the card on the EPOS website can be done using a tablet device. A credit card with an IC chip for enhanced security can be issued to the customer in as little as 20 minutes. Promoting the credit card to shopping customers is one of the top responsibilities of the store's sales staff. Each sales staff member in Marui Group retail stores is responsible for improving the cardholder acquisition process. The sales staff members are encouraged to apply ingenuity, going beyond the dictates of the standards manual. The sales staff of tenant shops are not Marui Group's employees. Therefore, members of the Marui Group Credit Card Division explain to the sales staff of tenant shops the importance of participating in the card membership subscription program. Marui Group's sales staff also work to develop a strong relationship with the sales staff of tenant shops by offering advice on ways to improve the store's operation, drawing on their own shop management experience. At Marui Group's retail stores, performance goals are set for the issuance of new credit cards (goals for both individuals and the entire sales floor). In order to achieve the performance goal set for the sales floor, cooperation from tenant shops is indispensable. The total number of customers who visited Marui Group's stores was 200 million in 2015.

Marui Group develops shopping centers outside of the group. Inside these shopping centers, Marui Group installs card centers; service and manufacturing companies that collaborate in sales promotion activities; and animation and game developing companies, which collaborate in the design of specialty cards and organize events.

At the shopping centers not owned by Marui Group, Marui employees are assigned to work at the credit card centers. These individuals have experience providing support to the sales staff of the tenant shops inside Marui Group's retail stores. They explain how the card will benefit tenant shops, and provide tenant shop sales staff with an effective sales pitch for the EPOS Card. In shopping centers that house the credit card centers of several competitors, the aggressive promotion of the EPOS Card by the tenant store staff is crucial for the successful acquisition of new cardholders.

Marketing

In order to understand customer needs, Marui Group puts an emphasis on direct communication with customers, in addition to utilizing web-based surveys. In the case of the Hakata Marui Department Store, which opened in April 2016, Marui collected feedback from 800 customers when it invited the submission of original designs for a credit card to be made available only at Hakata Marui. A design was selected based on the results of customer surveys, and the new card was issued. In the first two months after the Hakata Marui opened, about 20,000 cards had been issued. This is a record for Marui Group, and 64% of new cardholders selected the credit card featuring the Hakata original design. When Marui developed an official smart phone application for the EPOS Card, it collected feedback from customers regarding a selection of functions and screen designs. Marui Group values marketing activities that involve its customers. Such activities, known as "co-creation activities," embody Marui Group's credit philosophy, which emphasizes its commitment to "building creditability together with customers." The company's history attests to the effectiveness of its credit policy.

Credit philosophy

The credit limit for the EPOS Card is determined following a review of each customer's card usage history, which takes into account transaction amounts and late payments, in addition to annual income.

Group-wide Human Resources Management

Marui Group has only one group-wide human resource (HR) management system, which makes it easy to transfer an employee between specific functions, assignments, or even Group companies. As a result, the majority of Marui Goup's 6,000 employees have experience working in retailing operations. Many staff members of the credit card business had been transferred in from retailing operations. This has contributed to the development of retail-friendly card-issuance operations. In the four years from April 2012 to April 2016, 1,500 employees, (or 25% of total employees) had been transferred to positions outside of their business units.

IT System Development

Since issuing its first credit card in 1960, Marui Group has been undertaking the in-house development and management of its own IT system, and in the process Marui has accumulated much know-how. On top of this, most of the employees involved in the system development and management functions have experience in both retailing operations and the issuing of credit cards in retail stores. They understand the situation, can identify a problem, and develop a list of requirements for solving that problem in a shorter time. They complete more than 100 projects a year, and have made possible: 1) the on-site issuance of credit cards with IC chips; 2) on-site membership registration at the EPOS Card website; and 3) the on-site switch to a Gold Card. When a customer who qualifies for a Gold Card checks out with a cashier, a message appears on the cash register. After reading this message, the cashier recommends that the customer switch to a Gold Card. The IT system for the issuance of Gold Cards has been developed based on the IT system for the on-site issuance of ordinary credit cards.

In-house development and management of Marui Group's IT system reduces the risk of divulgence and misappropriation of data because the management of information is undertaken internally. For its in-house efforts to prevent the unauthorized use of credit cards, Marui Group was awarded the VISA Champion Security Award in the credit card issuers' category at the VISA Security Summit 2015, held in May 2015.

Fit among Activities

The activities of the Marui Group Credit Card Division have been selected in line with the company's basic policy to pursue the merger of retailing and credit card operations. Activities focus on young customers (the company's target customer), and credit risk management is based on the customer's credit card usage history. Employees with knowledge of both retailing and credit card operations conduct the on-site issuance of credit cards and help register customers for membership on the EPOS Card's website. This entire process is supported by an in-house developed IT system. Regarding its policy on "collaboration cards," the company has decided against adopting the common practice of issuing a limited-edition credit card for a specific collaboration partner. A cardholder can enjoy benefits provided by any of the collaboration partners using the one credit card. Collaborators, meanwhile, gain access to all of Marui Group's cardholders. Finally, Marui Group involves customers in the development of activities to which they will give their support under a policy entitled "Co-creation with Customers." (Please refer to Marui Group Co., Ltd., Credit Card Division's activity system map, which appears at the end of this report.)

Innovation that Enabled Strategy

- Credit card business developed by employees with a retailing background, enabled by a unique group-wide human resource (HR) management system.

- Promotion of card membership by sales staff members who work in the shops at department stores and shopping malls.

- IT system that enables a customer-friendly (and retail-friendly) registration process.

- The world's first on-site issuance system for credit cards equipped with IC chips.

- A single card serves as the platform for all collaboration partners.

Trade-offs

- Does not rely on annual membership fees as a source of income for its Gold Card. Instead, Marui Group makes its top priorities: 1) raising the number of Gold Card holders, and 2) increasing the credit card transaction volume. Growth in revenue is a result of charges on revolving credit payments and service fees from affiliated stores.

- Does not use the Gold Card to attract wealthy customers. Marui Group has selected young customers as the target customer for its Gold Card.

- Does not outsource systems related to operations.

- Does not issue multiple cards to one cardholder. With one EPOS Card, a cardholder can enjoy the benefits offered by any of the collaboration partners. Collaborators have the opportunity to attract another partner's customers.

Consistency of Strategy over Time

Marui Group's Credit Card Services business has its root in monthly installment sales, a practice that was started at the time of the company's establishment in 1931, as a furniture retailing shop. This practice was also aimed at serving young customers who had difficulty making a lump-sum payment for furniture, because individual items were relatively expensive. In 1960, Marui Group created the Marui Credit Center as a credit agency, and issued Japan's first credit card. Eventually, this sales practice of allowing customers to make payment for their purchases in monthly installments was renamed "a credit card service." The practice of on-site credit card issuance to improve convenience for cardholders dates back to 1975.

Consistencies of strategy throughout the Marui Group's history include: 1) a philosophy toward credit in which credit is not something retailers give their customers, but rather, an opportunity to help customers build their creditability; 2) a focus on young customers; and 3) a focus on customer convenience, such as the on-site issuance of credit cards.

While maintaining these consistencies, Marui Group made a big change in 2006. The company's house card, which previously could only be used at Marui's stores, was changed into a general credit card that could be used at all VISA-affiliated stores around the world. This change opened up new opportunities to customers by offering them greater benefits and bringing Marui Group an additional route for customer acquisition, i.e. through collaborations with other shopping centers and service companies.

Marui Group successfully survived the revision of the Money Lending Business Act (enacted in 2010), which lowered interest rates for cashing services. Following this revision, many non-banks and credit card service operators suffered from lower profitability. Marui Group, however, was able to change its revenue source from a cashing service to an installment and a revolving credit payment format, supported by the consistencies listed above.

Consistencies of strategy throughout the Marui Group's history include: 1) a philosophy toward credit in which credit is not something retailers give their customers, but rather, an opportunity to help customers build their creditability; 2) a focus on young customers; and 3) a focus on customer convenience, such as the on-site issuance of credit cards.

While maintaining these consistencies, Marui Group made a big change in 2006. The company's house card, which previously could only be used at Marui's stores, was changed into a general credit card that could be used at all VISA-affiliated stores around the world. This change opened up new opportunities to customers by offering them greater benefits and bringing Marui Group an additional route for customer acquisition, i.e. through collaborations with other shopping centers and service companies.

Marui Group successfully survived the revision of the Money Lending Business Act (enacted in 2010), which lowered interest rates for cashing services. Following this revision, many non-banks and credit card service operators suffered from lower profitability. Marui Group, however, was able to change its revenue source from a cashing service to an installment and a revolving credit payment format, supported by the consistencies listed above.

Profitability

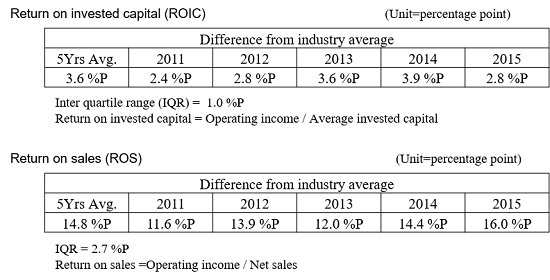

Both the five-year average return on invested capital and return on sales exceed the industry average by a wide margin. (Profitability analysis was conducted by PwC Japan.)

Activity System Map

Winners PDF

- 2016 Porter Prize Winners PDF (All of the award company in this year are published. )