Winners / Selection Rationale

ELECOM CO., LTD.

2019 19th Porter Prize Winner Supplier of PC and mobile phone peripherals, I/O devices and accessories

Elecom is one of the biggest suppliers of peripherals, I/O devices, and PC and smartphone accessories (such as mouse pads, mouse devices, keyboards, and earphones). The market for peripherals and accessories are directly affected by any changes made to the primary products, PCs and smartphones. This is an intensely competitive market because of the low barrier to entry and the large number of players. Many “new” products are usually upgraded versions of existing products, offering both enhanced features and lower prices. Elecom’s product line is easily the broadest in the industry. In addition, many Elecom products have secured the top share in their product category. The company introduces a much larger number of new products than its competitors in any given year. It should also be noted that Elecom’s salesforce far exceeds the competition in terms of numbers. These salespeople spur sales by making frequent visits to consumer electronics stores, the company’s main sales channel. At these retail outlets, members of Elecom’s sales staff improve displays and make product pitches to customers.

Elecom does not have factories. Merchandise is procured from numerous suppliers. The company focuses its internal product development efforts on carefully selected cutting-edge products. The company monitors the profitability of each product, sales person and sales office. For each product category, Elecom creates "tripod" teams, called "Category Owner Teams" (usually shortened to "COTs"). These teams consist of three employees, one each from R&D, procurement, and sales. COTs are responsible for product planning, product launches, and product termination. The effective utilization of COTs is what enables Elecom to efficiently manage such a broad product line.

* This report has been written by Professor Emi Osono based on: (1) the materials submitted by the winner for Porter Prize screening purposes; (2) interviews conducted by the Porter Prize Organizing Committee; and (3) publicly available information. It is being published with the winner's permission.

Background Information about the peripherals and accessories market in Japan

The market for peripherals and accessories for PCs, tablet PCs and smartphones is made up of numerous products, including mouse devices, USB memories, headphones and earphones, covers and cases for tablet PCs and smartphones, phone screen protective film, USB adapters, keyboards and numeric keypads, switches, external card readers, and game controllers. The largest product category is mouse devices, and the market for mouse devices is valued at 10 billion yen (US$91 million) in the BtoC segment. (*1) The size of the PC peripherals market is estimated to be 100 billion yen (US$909 million). When adding cases for smartphones and tablet PCs, protective plastic films, earphones, USB adapters, external keyboards, numeric keypads, external card readers, game controllers, and other accessories, the market is estimated to be about 250 billion yen (US$2.3 billion). (*2)

The market for peripherals and accessories for PCs, tablet PCs and smartphones is made up of numerous products, including mouse devices, USB memories, headphones and earphones, covers and cases for tablet PCs and smartphones, phone screen protective film, USB adapters, keyboards and numeric keypads, switches, external card readers, and game controllers. The largest product category is mouse devices, and the market for mouse devices is valued at 10 billion yen (US$91 million) in the BtoC segment. (*1) The size of the PC peripherals market is estimated to be 100 billion yen (US$909 million). When adding cases for smartphones and tablet PCs, protective plastic films, earphones, USB adapters, external keyboards, numeric keypads, external card readers, game controllers, and other accessories, the market is estimated to be about 250 billion yen (US$2.3 billion). (*2)The size of the market for each product category is small. Once a product has become technologically mature, existing manufacturers are no longer able to enjoy economies of scale. Also, the barrier to entry is low for many product categories. As a result, numerous small and medium-sized manufacturers (mainly in Asian countries) have started selling products under their own brand while simultaneously providing OEM and ODM services. (*3)

The product life cycle for such products is short. Peripherals and accessories must ensure compatibility with new standards and accommodate changes to the primary products, such as PCs and smartphones. For example, the market for cases emerged because of the introduction of the tablet PC. The market for game controllers emerged after computer game software became popular. It is also possible for peripherals to independently undergo their own evolution. Examples include advances made in screen surface protective film to precisely match a variety of applications and environments, and the development of the noise cancelling and reduction features for earphones. Neither was the result of changes in phone screens or smartphones.

The short product life cycle makes it imperative for companies to carefully manage new product introductions, product upgrades, and product terminations. Also, management priorities change as the product life cycle enters each new phase. In the introduction and growth phases, there are many new entrants. However, the size of the market is also rapidly expanding. As a result, competition is not so intense. In contrast, during the maturity and decline phases, many players exit because of harsh price competition. Consequently, only 3 to 5 players now remain. Even these remaining players cannot easily enjoy the benefits. Firstly, consumer electronics retailers have strong negotiating power over suppliers. Secondly, the remaining players will continue having to compete with each other.

The sales channel for the peripherals and accessory retail segment has been expanding from consumer electronics retailers to e-commerce and mass-market retailers. Although electronics retailers have consolidated to some extent, there are numerous small and medium-sized retailers remaining, which adds to the suppliers' selling expenses. In any sales channel, retailers do not allocate staff to oversee sales of peripherals and accessories. Suppliers have to make the products and packaging easy to understand, so that explanations by sales staff are unnecessary.

Intense competition throughout the product life cycle has resulted in the continuous introduction of a broad variety of new products. The market for peripherals and accessories in Japan has developed into a very crowded one, offering a large variety of products. Indeed, Japan's market is quite unique, especially when compared with the same market in other countries.

(*1) According to Elecom.

(*2) According to Elecom.

(*3) Suppliers of flash memories and hard disks are the exception, as these manufacturers have already been consolidated into a few remaining competitors.

Unique Value Proposition

Elecom designs and sells peripherals and accessories for PCs, tablet PCs, and smartphones in the BtoC segment. (*4)

The company's product line covers the broadest product categories. Elecom far outpaces all its competitors, reporting the largest number of new products launches every year. Furthermore, the company holds the top market share in numerous product categories. Elecom has 15,000 SKUs, and the company introduced 3,739 SKUs in 2018. (The two closest competitors introduced about 300.) (*5) The company has gained the top market share in 13 product categories. (The two closest competitors hold the top market share in 5 to 6 product categories.) (*6)

Elecom has two kinds of target customers. The first target is customers who, aware of their needs, are looking for solutions. The second target is customers who have not yet identified their needs, and who are unaware of how Elecom's product might help them.

The main value propositions for solution-seeking customers are firstly, superior products that offer a higher level of performance; greater ease of use; and enhanced aesthetic value attributable to better design. (*7) Secondly, a less stressful shopping experience. Thirdly, product packaging design that is not only eye-catching but also helps customers to understand the product contained inside and how it works. The fourth value proposition, which targets customers who are unaware of their needs, is to communicate possible solutions to customers who do not know how to make full use of the product in question, or are unaware of the product's benefits. For these individuals, the company invests in call centers. Easy-to-understand packaging draws their attention to the product, makes them aware of the product's existence, and hopefully prompts them to purchase the product. These value propositions are expressed in the central concept of Elecom's corporate branding: "Lifestyle Innovation." With this brand message, the company defines its mission as "Facilitating the evolution of technological innovation by helping people to navigate unfamiliar territory and use the new technology easily and comfortably for their own benefit. (*8)

Elecom sells its products through consumer electronics retail outlets and e-commerce. Consumer electronics retailers account for more than half of the company's sales. (*9) The value proposition to retailers is to create a shop floor that can generate sales without requiring the attention of sales staff. The provision of easy-to-understand, attractive product packaging makes this possible. Another contributing factor is the company's practice of selecting the most appropriate merchandise for each store. Sales of peripherals and accessories are not affected by economic conditions or seasonal changes, and bring stable daily sales revenue to retailers.

(*4) Elecom's affiliated companies conduct business in the BtoB segment with various electronic products and services.

(*5) According to Elecom.

(*6) According to the BCN Award 2019, which is based on sales at major retailers from January to December 2018. The award is organized by BCN Inc. (Formerly known as Business Computer News.)

https://www.bcnaward.jp/award/gallery/detail/contents_type=187

https://www.bcnaward.jp/award/gallery/detail/contents_type=245

https://www.bcnaward.jp/award/gallery/detail/contents_type=221

https://www.bcnaward.jp/award/gallery/detail/contents_type=215

https://www.bcnaward.jp/award/gallery/detail/contents_type=181

Accessed on November 25, 2019.

(*7) Elecom won 28 Good Design Awards from 2014 to 2018, while its competitors won less than half that number. Japan Institute of Design Promotion, https://www.g-mark.org/?locale=en https://www.g-mark.org/?locale=en, accessed on November 25, 2019. For the same five years, Elecom was awarded 14 iF Design Awards, while its award-winning competitors received less than one fourth of Elecom's total. iF Design Foundation, https://www.g-mark.org/?locale=en, accessed on November 25, 2019.

(*8) Elecom Co., Ltd. https://www.elecom.co.jp/brand/, accessed on November 25, 2019.

(*9) Fiscal year ended March 2019.

The company's product line covers the broadest product categories. Elecom far outpaces all its competitors, reporting the largest number of new products launches every year. Furthermore, the company holds the top market share in numerous product categories. Elecom has 15,000 SKUs, and the company introduced 3,739 SKUs in 2018. (The two closest competitors introduced about 300.) (*5) The company has gained the top market share in 13 product categories. (The two closest competitors hold the top market share in 5 to 6 product categories.) (*6)

Elecom has two kinds of target customers. The first target is customers who, aware of their needs, are looking for solutions. The second target is customers who have not yet identified their needs, and who are unaware of how Elecom's product might help them.

The main value propositions for solution-seeking customers are firstly, superior products that offer a higher level of performance; greater ease of use; and enhanced aesthetic value attributable to better design. (*7) Secondly, a less stressful shopping experience. Thirdly, product packaging design that is not only eye-catching but also helps customers to understand the product contained inside and how it works. The fourth value proposition, which targets customers who are unaware of their needs, is to communicate possible solutions to customers who do not know how to make full use of the product in question, or are unaware of the product's benefits. For these individuals, the company invests in call centers. Easy-to-understand packaging draws their attention to the product, makes them aware of the product's existence, and hopefully prompts them to purchase the product. These value propositions are expressed in the central concept of Elecom's corporate branding: "Lifestyle Innovation." With this brand message, the company defines its mission as "Facilitating the evolution of technological innovation by helping people to navigate unfamiliar territory and use the new technology easily and comfortably for their own benefit. (*8)

Elecom sells its products through consumer electronics retail outlets and e-commerce. Consumer electronics retailers account for more than half of the company's sales. (*9) The value proposition to retailers is to create a shop floor that can generate sales without requiring the attention of sales staff. The provision of easy-to-understand, attractive product packaging makes this possible. Another contributing factor is the company's practice of selecting the most appropriate merchandise for each store. Sales of peripherals and accessories are not affected by economic conditions or seasonal changes, and bring stable daily sales revenue to retailers.

(*4) Elecom's affiliated companies conduct business in the BtoB segment with various electronic products and services.

(*5) According to Elecom.

(*6) According to the BCN Award 2019, which is based on sales at major retailers from January to December 2018. The award is organized by BCN Inc. (Formerly known as Business Computer News.)

https://www.bcnaward.jp/award/gallery/detail/contents_type=187

https://www.bcnaward.jp/award/gallery/detail/contents_type=245

https://www.bcnaward.jp/award/gallery/detail/contents_type=221

https://www.bcnaward.jp/award/gallery/detail/contents_type=215

https://www.bcnaward.jp/award/gallery/detail/contents_type=181

Accessed on November 25, 2019.

(*7) Elecom won 28 Good Design Awards from 2014 to 2018, while its competitors won less than half that number. Japan Institute of Design Promotion, https://www.g-mark.org/?locale=en https://www.g-mark.org/?locale=en, accessed on November 25, 2019. For the same five years, Elecom was awarded 14 iF Design Awards, while its award-winning competitors received less than one fourth of Elecom's total. iF Design Foundation, https://www.g-mark.org/?locale=en, accessed on November 25, 2019.

(*8) Elecom Co., Ltd. https://www.elecom.co.jp/brand/, accessed on November 25, 2019.

(*9) Fiscal year ended March 2019.

Unique Value Chain

The unique features of the value chain for Elecom, a fabless supplier of peripherals and accessories, are: (1) product development; (2) procurement; and (3) sales.

Product category management

In order to manage a broad product line, as well as coordinate the R&D, procurement, and sales functions, Elecom creates virtual teams, called "Category Owner Teams" or "COTs," which consist of three members, hailing from R&D, procurement, and sales. The COT members are responsible for making swift decisions regarding product development, procurement and sales. Employees who are not in managerial positions may be appointed as COT members. Joining a COT enables employees to strengthen their decision-making capabilities.

Elecom's product strategy is to "keep products fresh and competitive." The company aims to harness the benefits of disrupting itself by changing or terminating successful products and suppliers. Consistent with this product strategy, the company continuously introduces new items to its product line of PC peripherals. Although there has been a declining trend in the sales of desktop and portable computers, the market for computer accessories and peripherals has been growing.

Product development

Elecom must respond to a rapidly changing market, characterized by the swift introduction of many new products and the quick termination of many others. Moreover, demand must be constantly stimulated by the successive introduction of new products. Only 30% of Elecom's new products are developed in-house, while the remaining 70% is undertaken by suppliers on an original design manufacturing (ODM) basis. The company limits its internal product development activities to those products for which suppliers' models cannot provide a satisfactory level of performance, such as network-related products and earphones.

Procurement

Elecom reaches out to over 1,000 potential suppliers a year, and eventually concludes agreements with ten or more suppliers. This process begins with staff members in Hong Kong, Shenzhen and Japan submitting lists of potential suppliers. The company then carefully undertakes a thorough assessment of numerous candidates, conducting both negotiations and factory audits, before making its final selection.

Most suppliers of peripherals and accessories are small in size. The factory audits conducted by Elecom are not limited to manufacturing quality and logistics management capabilities. These audits also assess the supplier's general management capabilities. Elecom will sometimes also provide suppliers with instructions or guidance, as required. To minimize risk, Elecom cultivates relationships with multiple suppliers, and engages in parallel sourcing from several suppliers.

Supply chain managementt

Elecom's logistics management has to deal with many suppliers and numerous products. The company is willing to make a delivery to its retailers for even one unit of a product. In order to improve supply chain management and lower inventory in the supply chain, Elecom has invested in management information systems and the automation of its distribution centers. The average inventory level has been about 1.5 months in recent years. The company leases its distribution center buildings, but owns the equipment and hires people to work at its distribution centers.

Sales and sales promotion

Elecom makes it a priority to keep store inventory low. The company selects the appropriate merchandise for each store, and conducts sales promotions in collaboration with retailers. Its sales staff, called "Rounders," set up product displays on the shelves, and arrange the displays in a way that Elecom products can catch the customers' attention. The company's salesforce is easily several times larger than the salesforce maintained by its competitors.

After sales service

Elecom has its employees respond to inquiries from consumers. The company also creates frequently asked questions (FAQ) contents to post on its website. (This is accessed by 25 million users a year.) The company's policy regarding customer inquiries is to "provide comprehensive support until the customer is able to use the product." The product development department is notified weekly of any claims and questions that have been received, and this feedback is used to make further improvements to new products.

Human resource management

At Elecom, employees who are not at the management level may be appointed to a COT, and are responsible for swiftly making business decisions. Management data on sales revenue, inventories and profits is shared with all employees. In addition, the company divides up its products and sales outlets into small groups, and assigns these groups to teams of individuals who have been given the authority to make speedy decisions. Meanwhile, knowledge sharing is broadly practiced at this company. Elecom conducts analyses and keeps a record in the database of successful and unsuccessful attempts to achieve profit targets, which in this case refers to marginal profit.

General management

Elecom has been investing in management information systems since 1996. Management information systems are used primarily for sales and procurement management. Every employee can find out the details concerning each product's sales performance, inventory status, and profitability on a real-time basis.

The company puts a priority on marginal profit. Elecom monitors and evaluates each product, each member of the sales staff, and each sales office in terms of "marginal profit." The monthly meeting focuses on the reporting of profits. Even if sales targets are not met, the sales staff will be praised if the profit targets are met.

Elecom's commitment to marginal profit as the key criteria for decision making helps individual employees make quick decisions. Given the intense competition in this business segment, decisions must be made and executed swiftly. The decision to terminate a product, for example, is usually made within the first three months after the product's launch.

The company's management is kept informed, with frequent updates. Executives receive reports daily and weekly regarding sales performance, new product development, and procurement activities. If an executive receives information that signals an opportunity or a threat, that individual can give instructions immediately, and employees will be able to act on those instructions.

Elecom communicates to employees its corporate culture through an 18-month project that each person must complete. Action Guidelines have been established. These Action Guidelines contain five items, namely: "Honesty, a common mission, a results-oriented mindset, consideration for others, and humility." (*10) To elaborate further, this involves "facing head-on any claims or problems, instead of hiding them or making excuses, and promptly identifying the best way to proceed; collaborating across departments and companies to meet challenging targets or solve difficult problems; considering what should be the highest priority, and determining the most efficient course of action; showing consideration to customers and business partners; and always demonstrating humility." According to Elecom, these guidelines help the company to improve collaboration among the companies that have joined its group.

(*10) Elecom Co., Ltd. https://www.elecom.co.jp/ir/enterprise/index.html , accessed on November 25, 2019.

Product category management

In order to manage a broad product line, as well as coordinate the R&D, procurement, and sales functions, Elecom creates virtual teams, called "Category Owner Teams" or "COTs," which consist of three members, hailing from R&D, procurement, and sales. The COT members are responsible for making swift decisions regarding product development, procurement and sales. Employees who are not in managerial positions may be appointed as COT members. Joining a COT enables employees to strengthen their decision-making capabilities.

Elecom's product strategy is to "keep products fresh and competitive." The company aims to harness the benefits of disrupting itself by changing or terminating successful products and suppliers. Consistent with this product strategy, the company continuously introduces new items to its product line of PC peripherals. Although there has been a declining trend in the sales of desktop and portable computers, the market for computer accessories and peripherals has been growing.

Product development

Elecom must respond to a rapidly changing market, characterized by the swift introduction of many new products and the quick termination of many others. Moreover, demand must be constantly stimulated by the successive introduction of new products. Only 30% of Elecom's new products are developed in-house, while the remaining 70% is undertaken by suppliers on an original design manufacturing (ODM) basis. The company limits its internal product development activities to those products for which suppliers' models cannot provide a satisfactory level of performance, such as network-related products and earphones.

Procurement

Elecom reaches out to over 1,000 potential suppliers a year, and eventually concludes agreements with ten or more suppliers. This process begins with staff members in Hong Kong, Shenzhen and Japan submitting lists of potential suppliers. The company then carefully undertakes a thorough assessment of numerous candidates, conducting both negotiations and factory audits, before making its final selection.

Most suppliers of peripherals and accessories are small in size. The factory audits conducted by Elecom are not limited to manufacturing quality and logistics management capabilities. These audits also assess the supplier's general management capabilities. Elecom will sometimes also provide suppliers with instructions or guidance, as required. To minimize risk, Elecom cultivates relationships with multiple suppliers, and engages in parallel sourcing from several suppliers.

Supply chain managementt

Elecom's logistics management has to deal with many suppliers and numerous products. The company is willing to make a delivery to its retailers for even one unit of a product. In order to improve supply chain management and lower inventory in the supply chain, Elecom has invested in management information systems and the automation of its distribution centers. The average inventory level has been about 1.5 months in recent years. The company leases its distribution center buildings, but owns the equipment and hires people to work at its distribution centers.

Sales and sales promotion

Elecom makes it a priority to keep store inventory low. The company selects the appropriate merchandise for each store, and conducts sales promotions in collaboration with retailers. Its sales staff, called "Rounders," set up product displays on the shelves, and arrange the displays in a way that Elecom products can catch the customers' attention. The company's salesforce is easily several times larger than the salesforce maintained by its competitors.

After sales service

Elecom has its employees respond to inquiries from consumers. The company also creates frequently asked questions (FAQ) contents to post on its website. (This is accessed by 25 million users a year.) The company's policy regarding customer inquiries is to "provide comprehensive support until the customer is able to use the product." The product development department is notified weekly of any claims and questions that have been received, and this feedback is used to make further improvements to new products.

Human resource management

At Elecom, employees who are not at the management level may be appointed to a COT, and are responsible for swiftly making business decisions. Management data on sales revenue, inventories and profits is shared with all employees. In addition, the company divides up its products and sales outlets into small groups, and assigns these groups to teams of individuals who have been given the authority to make speedy decisions. Meanwhile, knowledge sharing is broadly practiced at this company. Elecom conducts analyses and keeps a record in the database of successful and unsuccessful attempts to achieve profit targets, which in this case refers to marginal profit.

General management

Elecom has been investing in management information systems since 1996. Management information systems are used primarily for sales and procurement management. Every employee can find out the details concerning each product's sales performance, inventory status, and profitability on a real-time basis.

The company puts a priority on marginal profit. Elecom monitors and evaluates each product, each member of the sales staff, and each sales office in terms of "marginal profit." The monthly meeting focuses on the reporting of profits. Even if sales targets are not met, the sales staff will be praised if the profit targets are met.

Elecom's commitment to marginal profit as the key criteria for decision making helps individual employees make quick decisions. Given the intense competition in this business segment, decisions must be made and executed swiftly. The decision to terminate a product, for example, is usually made within the first three months after the product's launch.

The company's management is kept informed, with frequent updates. Executives receive reports daily and weekly regarding sales performance, new product development, and procurement activities. If an executive receives information that signals an opportunity or a threat, that individual can give instructions immediately, and employees will be able to act on those instructions.

Elecom communicates to employees its corporate culture through an 18-month project that each person must complete. Action Guidelines have been established. These Action Guidelines contain five items, namely: "Honesty, a common mission, a results-oriented mindset, consideration for others, and humility." (*10) To elaborate further, this involves "facing head-on any claims or problems, instead of hiding them or making excuses, and promptly identifying the best way to proceed; collaborating across departments and companies to meet challenging targets or solve difficult problems; considering what should be the highest priority, and determining the most efficient course of action; showing consideration to customers and business partners; and always demonstrating humility." According to Elecom, these guidelines help the company to improve collaboration among the companies that have joined its group.

(*10) Elecom Co., Ltd. https://www.elecom.co.jp/ir/enterprise/index.html , accessed on November 25, 2019.

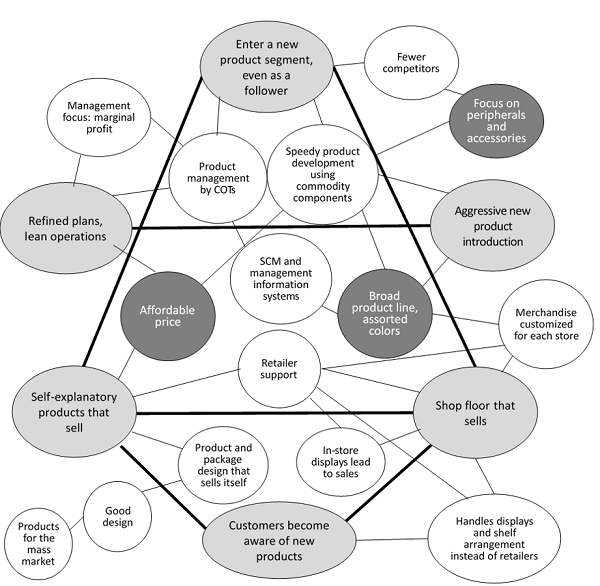

Fit among Activities

Elecom's activities are optimized to respond to the ever-changing peripherals market. In addition, the company works to proactively create change. The sales promotion activities undertaken at consumer electronics stores are another core element of the company's activity system. Product design and packaging that does not require an explanation by sales staff is effective for e-commerce sales channels too. (Please refer to Elecom's activity system map, which appears at the end of this report.)

Innovation that Enabled Strategy

- Expanded the computer peripherals market by continuing to undertake product development even after core products became technologically mature and sales started to decline. This created a rich and deep computer peripherals market in Japan, one that is unparalleled in the world.

Trade-offs

- Elecom does not have any factories. Does not build fixed relationships with contracted manufacturing companies, such as through capital investment. (*11) The reason why the company has selected a fabless approach is "to keep its products fresh and competitive." For this reason, the company is continuously looking for new suppliers, and will not hesitate to terminate existing suppliers and establish relationships with new suppliers.

- Does not enter the core product business, such as PCs, smartphones or televisions. Instead, the company focuses on computer peripherals and accessories, although vertical integration would bring some advantages. Apple, for example, has successfully pursued this strategy and enjoyed such benefits.

- ? Does not avoid the consumer electronics retailer channel. Although this channel has undergone consolidation to some extent, there are still many small retailers across the nation. To reach them would be costly. Also, retailers, including small retailers, tend to be demanding (a long-standing business practice in Japan). To raise efficiency, Elecom could conduct business with retailers indirectly by working with wholesalers or agents. The company could choose to avoid retailers altogether and instead focus on the e-commerce channel. However, Elecom chooses to sell directly to consumer electronics retailers.

- Does not introduce products that feature popular characters, neither does it sponsor events. The company maintains an unwavering focus on the development of small products, working tirelessly to reduce costs and minimize opportunity loss.

(*11) Its affiliate company, Logitech INA Solutions, has a factory. That company only makes products that require small-batch production and quick delivery, like industrial-use PCs, etc.

Consistency of Strategy over Time

Elecom was founded as a manufacturer of furniture for business machines. Its first product was computer desks. The following year, the company entered the accessories market with a floppy disk case. The introduction of computer mouse devices, the numeric keypad, and the floppy disk drive followed.

The company has consistently pursued the same growth strategy over time, entering neighboring areas. This applies to both product segments and sales channels.

Elecom has been avoiding a product-out approach. Rather, the company has adopted a customer-centric approach. Indeed, Elecom's foremost priority is to help solve customers' problems. This approach is reflected in: (1) its products, which are less dependent on in-house product development capabilities; (2) a product line that is centered primarily on procurement; and (3) merchandising and sales promotion initiatives that are customized for each specific store and region.

The company has created a system that allows all members of the organization to put priority on swift decision making. This is what enables an efficient response to an ever-changing market and the effective handling of a broad product line.

The company has consistently pursued the same growth strategy over time, entering neighboring areas. This applies to both product segments and sales channels.

Elecom has been avoiding a product-out approach. Rather, the company has adopted a customer-centric approach. Indeed, Elecom's foremost priority is to help solve customers' problems. This approach is reflected in: (1) its products, which are less dependent on in-house product development capabilities; (2) a product line that is centered primarily on procurement; and (3) merchandising and sales promotion initiatives that are customized for each specific store and region.

The company has created a system that allows all members of the organization to put priority on swift decision making. This is what enables an efficient response to an ever-changing market and the effective handling of a broad product line.

Profitability

Elecom's five-year averages for the return on invested capital (ROIC) and the return on sales (ROS) exceeded the industry average by a wide margin. (Profitability analysis was conducted by PwC Japan.)

Activity System Map of Elecom

Winners PDF

- 2019 Winners PDF Eng (All of the award company in this year are published. )