Winners / Selection Rationale

YOHO Brewing Company

The company undertakes product development with the goal of getting one person in 100 to show a strong preference for its beers. To this end, YOHO Brewing has created craft beers that have a truly original taste, an unusual name, and an unconventional can design. Normally, the company's lineup includes more than 10 beer products. YOHO Brewing's Yona Yona Ale and two other best-selling beer products are distributed nationwide. Production of these three pale ale products has been outsourced to Kirin Beer. In addition to new product development, the company undertakes mainly small-scale production of numerous pale ales at its own beer brewing facilities.

YOHO Brewing hosts both in-person and online events, and arranges promotional events that involve customer participation. The company works continually to increase opportunities for two-way communication between its employees and customers. Through such interaction, employees and customers are able to form on-going and long-lasting relationships. One of the ways that the company nurtures these relationships is via its e-commerce site. Through this site customers can place regular orders for craft beer and also receive updates about upcoming events and activities. By producing special events for fans, YOHO Brewing is able to create a base of enthusiastic fans who will serve as brand evangelists.

* This report was written by Professor Emi Osono of Hitsubashi University Business School and the "Porter Prize Writing and Masquerade PJ Team" at YOHO Brewing, based on: (1) the materials submitted by the winner for Porter Prize screening purposes; (2) interviews conducted by the Porter Prize Organizing Committee; and (3) publicly available information. It is being published with the winner's permission.

Background Information about the Beer Industry

The beer market in Japan is comprised of beer, beer-flavored drinks like happoshu low-malt beer, and a "new genre beer." Also known as the "third beer," new genre beer has lower levels of malt and is made also from grains like rice, corn, sorghum, potato, starch, and sugar. This is a highly concentrated industry, dominated by Japan's five industrial beermakers (Kirin, Asahi, Sapporo, Suntory, and Orion). Their combined production volume accounts for 99% of the total. According to the National Tax Agency, there were 303 microbreweries in Japan in 2018. Excluding the top five major beermakers, there is a market comprised of numerous small-capacity craft beer breweries. In this market, companies with an annual production volume of less than 100 kiloliters of beer account for 83% of the total number of the producers.

In terms of the overall market size, the beer market peaked in 1994, after which it began flattening out until 2002, when it started to shrink. Currently, the beer market has shrunk to about half the previously size (on a volume basis), and people appear to be losing interest in alcoholic beverages. The size of the market for alcoholic beverages as a whole peaked in 1999, and has since declined by more than 10%. Of this total, the decline in the consumption of beer and beer-like drinks has far outpaced other alcoholic beverages. The demand for beer and beer-like drinks appears to have been absorbed by liquor and other alcoholic beverages such as whiskey and wine. From 2011 onward, beer consumption has continued to decline by 1-2% each year.

Regarding sales routes, the dominant route has been a restaurant attached to some type of business complex, which accounted for 38.0% (in terms of number of business operators); wholesalers and others made up 31.4%; supplying to restaurants and chain stores comprised 23.4%; while facilities within theme parks, souvenir shops, and kiosks attached to some type of business complex came to 7.3%. In recent years, however, bars and pubs as a sales route have declined conspicuously. Bars and pubs are included in the "restaurants and chain stores" supply channel.

As notable recent trend, sales of craft beers have been growing despite the fact that beer and beer-like beverages have reported a declining trend. According to a YOHO Brewing survey, consumption of craft beers has been growing by 4-5% for several years now. Historically, Japan's leading beermakers specialized in the production of a fermented malt lager-style beer, made using lager yeast and a bottom fermentation process. Japan's top makers focused especially on the production of Pilsner beer. (The predominant feature of lager beer is the smooth feeling in the throat, known also as the "mouthfeel." In other words, lager beer is easy to drink.) Then, in April 1994, the Liquor Tax Law was amended, allowing for microbrewers to enter the beer market. Since then, microbrewers have been supplying pale ale beers made through a top fermentation process using ale yeast, as this production method allows for small-scale production. Up until then, competition in the beer market had been pursued solely within the lager beer category. Suddenly, ale-style beers that featured a distinctly different taste from lager beers had entered the market. Small-scale production allowed microbrewers to take on the challenge of coming up with beers that had a truly unique taste. This leads to a diversification of beer flavors. The result was an all-new segment, known as "craft beer."

The definition of "craft beer" is vague. "Craft beer" usually refers to the specialty beer products produced by microbreweries. That said, the leading industrial brewers, when developing a beer with a unique taste, will frequently call that beer "a craft beer."

We will now take a look back at how the craft beer market took shape in Japan. Through the amendment of the Liquor Tax Law in April 1994, the minimum production requirement for securing a brewing license was reduced from 2,000 kiloliters per year to 60 kiloliters per year. As a result, numerous microbreweries began producing small batches of craft beer. In Japanese, craft beer is known as "ji-biru," which means "locally produced beer." The new entrants to this market included sake brewing companies, theme parks, and private-public joint venture companies aiming to revive the local economies. The majority were business operators who ran some other business as their main business. The unusual flavors of craft beers began attracting the interest of Japanese consumers. Within a short time craft beer's popularity grew, and Japan experienced a "ji-biru" boom in the mid-1990s. For example, there was the formal gift-giving of craft brews that were being sold as "local specialty products." These were ordered from microbreweries scattered throughout Japan. Craft beers were also being brought home as omiyage (a souvenir) from some specific destination.

The initial "ji-biru" boom ended sometime in the early 2000s, due in part to the rising popularity of the low-priced happoshu low-malt beer, which had succeeded in establishing a presence in the market. Other reasons for the decline in popularity of craft beers include: (1) the taste of these beers was too different, only appealing to a limited number of people; and (2) the fact that some microbrewers were unable to stabilize the quality of their craft beers. During this period, some Japanese microbrewers went overseas to study beer brewing techniques. These brewers improved their brewing techniques and succeeded in producing higher-quality craft beers. In the years before and after 2015, craft beer saw its popularity grow in the U.S. This happened in Japan as well, with craft beer returning once again to the spotlight.

That said, as explained at the beginning of this report, Japan's five leading beermakers together accounted for 99% of total production. All the other beermakers comprised a mere 1% share of production on a volume basis. In the U.S., craft beer enjoys a 13.6% share on a volume basis, and a 25% share on a value basis. Craft beer trends in the U.S. suggest that Japan's craft beer market can be expected to show solid growth in the future.

The four leading beermakers can be divided into two groups in terms of the approach that they are taking toward the craft beer segment. Kirin and Sapporo are in one group, and Asahi and Suntory are in the other. Kirin and Sapporo have developed an all-new brand for their craft beers. (When you look at the new craft beer products, you wouldn't know that these two companies were the producers.) In contrast, Asahi and Suntory have their company logos prominently displayed on the product packaging. In addition to linking the craft beer to their corporate brand, Asahi and Suntory use the word "craft" to make it clear that this beer product is not a lager beer.

Among the four top beermakers, Kirin Beer has been making the most aggressive efforts with regard to craft beer. Kirin formed a business and capital tie-up with YOHO Brewing in 2014. Then, in 2015, the company opened the Spring Valley Brewery restaurant in Tokyo's upscale Daikanyama shopping district. In 2016, Kirin formed a capital tie-up with Brooklyn Brewery of the U.S., and began distributing that company's products in Japan. In addition, Kirin has debuted a new beer dispenser to help restaurants more easily serve craft beers. Kirin's new beer dispenser, Tap Marché, comes with either two taps or four taps. Restaurants can choose from 20 beer varieties on offer, made by various craft beer makers. Among those 20 beers are craft beers produced by Spring Valley Brewery, YOHO Brewing, and Brooklyn Brewery, among others. Many of Japan's domestic craft beers are included. The compact Tap Marché craft beer dispenser does not take up much space. The beer is served in 3 liters PET bottles, and this PET bottle does not have to be returned, which makes it easy to use for restaurants. Tap Marché is already being used in 13,000 restaurants. In November 2019, Kirin announced the acquisition of the U.S. craft beer maker the New Belgium.

In 2015, Sapporo Beer introduced its own product, "Craft Label Citrus Pale Ale," through its 100% subsidiary Japan Premium Brew Company. Then, in 2017, Sapporo Beer acquired the American company Anchor Brewing, a long-established craft beer maker. Finally, in 2019, Sapporo Beer launched its "Innovative Brewer" brand through its own company. In this way, Sapporo Beer has launched a series of pale ale beers in rapid succession.

Suntory Beer has its own "Craft Select" series. The company has also started selling its "Brewed in Tokyo" series, which is produced at its beer brewery plant in Musashino City (located in western Tokyo).

Asahi Beer established Tokyo Sumidagawa Brewing in 1994. The company operates a pub brewery in Sumida Ward, Tokyo. In addition, Asahi Beer operates a microbrewery in Ibaraki Prefecture. Under the Asahi Beer brand, the company has started selling its "Asahi Craft Style" series of craft beers. In its medium-term management plan, which began in FY2018, Asahi Beer indicated that its priority is the premium segment of the global beer market.(*8) Since then, the company has acquired Peroni (Italy) and Pilsner Urquell (Czech) from the world's largest beer company, Anheuser-Busch InBev (Belgium). Asahi Beer has also announced plans to expand sales of Asahi Super Dry and its other beer products in the premium segment of the global beer market.

(*1) National Tax Agency, 2020, "Overview of Craft Beer Production in Japan" (Survey for FY2018). https://www.nta.go.jp/taxes/sake/shiori-gaikyo/seizogaikyo/beer/pdf/h30/h30beer_all.pdf. (Last accessed on Nov. 27, 2020.)

(*2) Same as above.

(*3) Same as above.

(*4) National Tax Agency, 2020, Changes in the Taxation Amount on Alcoholic Beverages (Survey for FY2018). https://www.nta.go.jp/taxes/sake/shiori-gaikyo/shiori/2020/pdf/026.pdf (Last accessed on Nov. 25, 2020.)

(*5) Happoshu, with its low malt content, is technically not a beer. In Japan, the higher the malt content, the higher the tax. Consequently, happoshu is taxed at a lower rate than beer, and is priced lower than beer.

(*6) According to statistics provided by the Brewers Association, an American independent trade association for small and independent craft brewers. The data is for 2019. https://www.brewersassociation.org/statistics-and-data/national-beer-stats/ (Accessed on Nov. 25, 2020.) The Brewers Association defines craft brewers as: "Small, independent brewers." According to the same association, all statistics and data are consistent with this definition. These brewers operate their own breweries on a small scale (less than 6 million barrels annually, the equivalent of 700 million liters). Furthermore, the brewers are independent, in that no beverage or alcohol industry member has more than a 25% stake in the craft brewery. https://www.brewersassociation.org/statistics-and-data/craft-brewer-definition/ (Accessed on Nov. 25, 2020.)

(*7) Kirin Brewery Company, Ltd.'s Tap Marché homepage, https://www.tapmarche.jp/, accessed on Nov. 25, 2020.

(*8) Asahi Holdings' website, https://www.asahigroup-holdings.com/company/summary/, accessed Nov. 25, 2020.

Unique Value Proposition

The value proposition of YOHO Brewing is to provide "the craft beer experience." The value that YOHO Brewing offers its customers can be defined as: (1) a truly unique taste; (2) the chance to see the brewers' faces; and (3) an opportunity to witness innovation in action. YOHO Brewing's "craft beer experience" is not limited to the mere supply of craft beers. The company aims to offer a unique experience, one that will allow for communication between customers and employees, and ultimately contribute to the creation of new fans. As a first step, the company utilizes various means for communicating with its customers. Strongly committed to a customer-centric approach, the company then goes one step further by coming up with ways to get customers involved in its activities. This is consistent with how YOHO Brewing defines its business: "An entertainment business centered on beer." Rather than focus on short-term sales, market share expansion and new customer acquisition, YOHO Brewing states as its management goal the cultivation of deep and long-term relationships with customers, according to the company. YOHO Brewing's ultimate aim is to become an indispensable part of its customers' lives. The company believes that this will result in the creation of enthusiastic fans who will serve as brand evangelists for YOHO Brewing. The company's mission is to give "Flavor to beer and Happiness to life!" The company seeks to provide a variety of flavors in a country where all beer tastes the same. According to YOHO Brewing, it is committed to "delivering a little happiness to beer fans by creating a new beer culture in Japan."

YOHO Brewing specializes exclusively in pale ales. The company normally offers about 10 different varieties of beer products. The feature of YOHO Brewing's beer products is that each product has a unique personality, one that really stands out. This unique personality is not merely the result of a distinctive flavor. There is an entire process involved. The company begins by envisioning the type of person who would be drawn to a certain product, and then the developers ask, "What would this person like? They then consider how the beer drinking experience would be positioned in that person's life. From this line of thinking the developers come up with various images. These images are then tied back to the beer drinking experience. The end result is that each product has its own unique personality, one that matches the preferences of adventurous customers and creates a feeling of familiarity. This approach of visualizing a particular type of customer makes it easier to establish an emotional connection with more customers. (*9)

With regard to product development, the company has outlined a "customer persona" for each product. The customer persona for Yona Yona Ale (lit., "Every Night Ale"), with its full citrus flavor, is: "Someone a little different from most people, someone whose hobbies and tastes don't easily fit into a mold." The company envisions the typical customer as: "An adult male, around age 40, with his own values, who likes to drink beer." For Suiyoubi No Neko (lit., "Wednesday Cat"): "A career woman who has a job with a certain amount of responsibility; she has a strong fashion sense and is particular about her accessories. She wakes up early on her day off to go to yoga class. This woman is in her thirties and lives along the Toyoko Line (which runs between Shibuya and Yokohama)." Suiyoubi No Neko is a Belgium White Ale that uses coriander seeds and orange peels. It is a yeasty beer with a taste of bananas and citrus fruit. Incidentally, the product Suiyoubi No Neko, which features a colorful calico cat (made of paper cutouts?) against a pale blue background, aims to promote beer drinking on what would normally be a slow day for beer sales in Japan.

YOHO Brewing creates excitement for its craft beer products by deliberately selecting extremely unusual names, such as Yona Yona Ale, Suiyoubi No Neko, and Aooni ("Blue Demon"). (In Japanese mythology, the oni is a type of ogre, and the skin of this demon is often blue or red.) Aooni is an American-style India Pale Ale, a hoppy beer with a strong bitterness. The playful and quirky illustrations that appear on the cans of these three craft beers reinforce the customers' impression that these products, with such unconventional designs, are indeed new and different.

Of the more than 10 products, several craft beers like Yona Yona Ale and Suiyoubi No Neko are popular mainstay items that are sold in large volume and distributed widely. The other products are available only now and then.

The company's employees communicate directly with customers to establish a strong relationship with them. Such communication also contributes to the company's value proposition of providing customers with a genuine "craft beer experience." YOHO Brewing's idea of communication is two-way communication. Not only that, the ideal form of communication involves the customers' participation in some kind of event. The company makes it a point to use a central theme, something enjoyable. For example, YOHO Brewing's e-commerce site allows customers to place orders on a regular basis. On this site, the company also introduces an unusual lineup of fun activities all centered on craft beer. One series of articles encourage customers to combine craft beer and other activities. This series is entitled, "The Yona Yona Outdoor Club." The friendly writing style of these articles makes them read like updates about activities for club members. These articles are not intended exclusively for sales promotion purposes, but rather as a means of providing entertainment to anyone visiting the company's website. In addition, these articles mention photos of YOHO Brewing beer products that have been posted by customers on various social media. At fan events, customers can experience the kind of activities that have been featured in the articles. In this way, YOHO Brewing is able to increase opportunities for two-way communication between its employees and customers.

Fan events are designed to help customers learn more about the company and its operations, and inspire them to become fans. The "BeerFes" (short for "Beer Festival") is a frequently held event. Beer and food are provided at this event, during which new and existing customers have a chance to mingle. Of course, an event like this provides the company with an opportunity to increase sales revenue. However, YOHO Brewing makes "improving customer engagement" the top priority for such events. The company's popular and most large-scale event is the "Yona Yona Ale Super Party." In addition to making beer available, the company shares with the event participants detailed information about the fermentation process. This is followed by a beer tasting class. The company also develops event content to satisfy the curiosity of customers who want to learn more about their favorite craft beers. YOHO Brewing has held fan events more than 500 times so far. To date, roughly 44,000 people have attended these events. In 2019, an event to accommodate 10,000 people was scheduled, but it had to be cancelled at the last minute because of a typhoon. It would have been the largest event independently organized by a beer maker in Japan. At fan events, the majority of the company's staff are involved in either running the event or taking part in it. This interaction with fans gives YOHO Brewing employees a chance to establish genuine relationships with them. Moreover, fans are given the opportunity to help run events, and are encouraged to play a more active role in the festivities. These days, YOHO Brewing and fans work together to create these events, a process that allows for the strengthening of relationships over time. Customers who took part in such events have expressed an extremely high level of satisfaction. (*10)

Enthusiastic fans with a strong appreciation for YOHO Brewing's fan events have been organizing events in a "fan-driven" way. For example, 20 fans got together to plan and host a Fan Party in 2018. This event was "held for fans, and organized by fans." YOHO Brewing's employees were also invited. Since then, fans have been organizing their own parties, which include a Super Fan Party that was held for 100 fans.

The outbreak of COVID-19 in early 2020 made it necessary to practice self-restraint with regard to public gatherings. YOHO Brewing responded to the pandemic by organizing an online "Home Party." About 10,000 fans participated in this virtual event. The company had already been holding small-scale drinking parties online since 2015, long before the outbreak of the current pandemic. The theme is always different, depending on the season, the new product being released, or the type of event being planned. Nevertheless, such online events give employees the opportunity to communicate with fans using the chat function. To date, online gatherings have been held more than 44 times (about once every two months). (*11)

(*9) According to the company's customer survey, YOHO Brewing's customers indicated that they resonate with the following values: "Realizing one's dreams," "A sense of healing and relaxation," "Self-conviction," "Sharing a world view," and "Making friends."

(*10) According to a customer survey conducted by YOHO Brewing after a Super Party Event in 2018, customers indicated a satisfaction rate of 94.6%.

(*11) As of Dec. 1, 2020.

Unique Value Chain

The most predominant features of YOHO Brewing's value chain are product development, manufacturing, sales, marketing and promotion, customer service, human resource management, communications, and the corporate climate.

◆ Technology developmentYOHO Brewing continuously works to develop sophisticated craft beer products that ooze personality. The company enters its beer products into beer competitions around the world, and always welcomes this kind of external objective feedback.(*12) Also, the company has continuously been exchanging knowledge and techniques with brewers in the U.S. and Europe, countries that have been at the forefront of the craft beer movement. At the same time, YOHO Brewing has been gathering the world's leading brewing technologies and equipment, and collecting market information.

YOHO Brewing has sold beer products made with Japanese ingredients like katsuobushi (dried bonito), the citrus fruit yuzu, and the salt pickled leaves of sakura (cherry blossom) trees, among others. The company was the first to produce cutting-edge beer products that have yet to be mass produced in Japan. In this way, YOHO Brewing is working to produce truly innovative products.

(*12) Yona Yona Ale has won a gold award at the International Beer Competition in the American Pale Ale category for eight consecutive years (2000─2008). IPA2016 won a silver award at the World Beer Cup 2016 in the American-Style Strong Pale Ale category. Karuizawa Beer Craft Zaurusu Black IPA won a silver award at the International Beer Cup 2018 in the American-Style Pale Ale category. Craft Zaurusu Black IPA won the copper award in the International Beer Cup 2019 in the American-Style Black Ale category.

◆ Product developmentYOHO Brewing usually carries more than 10 beer products in its product line. However, the company is not targeting the mass market. Rather, each of the company's products has been developed to serve a niche segment, with a limited market scale. YOHO Brewing's approach to product development is: (1) pursue differentiation from competitors to the degree that they would hesitate to try and imitate the company's products; (2) maintain a narrow and concrete target; and (3) accept the existence of pros and cons.

As part of the product development process, the team creates a very realistic persona for each product, and narrowly defines the target customer. Moreover, the team works tirelessly to develop the kind of product taste, packaging (beer can design), and naming that would closely match that target customer's values and preferences. The team selects the product candidate that received an extremely high rating by a particular group of subjects over candidates with a higher average score. Then, the team will make additional efforts to enhance the selected product's uniqueness. This approach is plainly visible in the beer can designs for Boku Biiru Kimi Biiru (translated on the can as "For You and Me Beer") and Suiyoubi No Neko. It is hard to tell whether the expressionless cat on the Suiyoubi No Neko can is laughing or not. A lime-green frog appears on the Boku Biiru Kimi Biiru can. The frog, which wears a Bowler hat, is a line drawing. This giant frog is seated on the top of two office buildings in the city. This illustrated frog may be crudely drawn, but it is very charming. At first glance, it is not obvious that these are even beer products, they have so much personality. All YOHO Brewing's products are like that. (*13)

Product development is undertaken as a cross-functional project, and individuals responsible for beer production are involved from the earliest stages of marketing. This approach helps the beer production teams to understand more deeply the targets of each product, and allows for two-way discussions. All members of the staff including individuals from outside the beer production department can freely undertake beer-making (the company has a "try your hand at brewing your own craft beer" system). Building such a "trial and error" process into the product development process facilitates a type of free association that leads to new ideas, and contributes to boldness in product development.

(*13) Consumer groups have pointed out that there is a risk that minors might mistakenly consume alcoholic beverages when the beer can does not clearly indicate that it is not a soft drink. (Japan's leading beer companies make it a policy to avoid using a potentially misleading design on beer cans and packaging.) In July 2000, the Housewives' Association, one of Japan's consumer groups, sent a petition to the Director General of the National Tax Agency and the chairperson of the Brewers Association of Japan, among others. The petition was entitled, "A Petition to Prevent Underage Drinking." Among the requests included in the petition: "Do not use a package design that might be mistaken at first sight for some other type of beverage." https://shufuren.net/requests/requests052/ (Last accessed on Nov. 25, 2020.) After reviewing its actual sales data, YOHO Brewing concluded that it would be extremely unlikely that anyone would mistakenly drink the company's beer products. YOHO Brewing continues to use unconventional designs that go against the industry's standard practice.

◆ Beer productionYOHO Holdings operates two small-scale breweries, and undertakes small-batch production at these breweries. The company's nationally distributed leading products, like Yona Yona Beer and Suiyoubi No Neko, require large-scale production. For this reason, YOHO Brewing has decided to outsource production through "contract brewing." The company has formed a business and capital tie-up with Kirin Beer for the production and packaging of its nationally distributed products. Thus, the company has pursued a two-prong approach to production: (1) contract brewing, which enables YOHO Brewing to secure the production capacity required to distribute products nationwide; and (2) in-house brewing of a wide variety of beers in small batches, with a focus on the development of unique craft beer products.

◆ SalesYOHO Brewing is concentrating its efforts on sales channels that would be difficult for the leading competitors to imitate. Firstly, the company runs its own e-commerce site. Through online sales, YOHO Brewing is able to deliver products to all parts of Japan, reaching areas that are not served by traditional retail channels. Moreover, the company can sell as little as one item per order. Furthermore, the online sales format provides opportunities for communication with customers. This gives YOHO Brewing the chance to impress upon customers the uniqueness of its brand.

In 2007, the company began offering a home delivery service, called "Yona Yona Monthly Life." Each month customers are able to freely choose from among YOHO Brewing's lineup of craft beer products, including limited-release beers. Subscribers to this service can also receive the company's e-zine, which contains advice about ways to enjoy beer and other kinds of information. Other advantages include the right to register early for fan events and the receipt of discount coupons that can be used at the company's official restaurant "Yona Yona Beer Works." Such incentives help to inspire fan loyalty. In September 2020, the number of customers who subscribed to Yona Yona Monthly Life home delivery service came to 5,400. Of this total, more than 90% had renewed their subscriptions.

Despite the benefits of online sales, it would be difficult for the leading beer companies to expand to their online sales, as this would draw a negative reaction from the distribution sector and result in a decline in their share of in-store shelf space.

The second sales channel on which YOHO Brewery focuses is the local sales territory of Karuizawa (a mountain resort in Nagano Prefecture), which has the highest share of craft beer sales in Japan. Karuizawa is the home of YOHO Brewing, and for this reason the company has concentrated its sales efforts in Karuizawa as a special priority sales territory. Taking full advantage of its proximity to this sales territory, the company undertakes frequent sales calls and provides a high level of service to the local merchants. Through these actions YOHO Brewing has been able to gain the trust of the local retail shops. As a result, Karuizawa's top supermarket chain Tsuruya carries a full lineup of the company's beer products. Actually, the Tsuruya Karuizawa store is rumored to be "sacred ground" for YOHO Brewing. This store receives visits from fans scattered throughout Japan. Not only that, buyers nationwide have made a special trip to this store, to check it out. If the leading beer companies were to adopt this practice of concentrating sales efforts on a single sales territory in rural Japan, suppliers from other parts of Japan would insist on a similar type of arrangement. This would likely result in higher costs. Clearly, this is an approach that the leading beer companies would hesitate to imitate.

Thirdly, YOHO Brewing relies on distributors who have a strong compatibility with the target customer. Specifically, distribution is limited to the major convenience store chain Lawson's, the upscale supermarket Seijo Ishii, and others. For sales to restaurants, the company focuses its efforts on a business tie-up with Wondertable, Ltd., the official beer restaurant Yona Yona Beer Works, and Kirin Beer's craft beer server Tap Marché, which is targeted at restaurants. In this way, YOHO Brewing is able to efficiently reach those target customers who are most interested in craft beer.

◆ Marketing and promotionYOHO Brewing's communication and promotion are set to match the level of the customers' brand loyalty, and are designed to raise that brand loyalty. From the initial stage, the company uses forms of communication like social media and email newsletters to deepen the customers' understanding about YOHO Brewing, with the aim of helping them gain a favorable impression of the brand. Once customers have developed positive feelings toward the company, it is very likely that these customers will start attending all kinds of fan events developed by YOHO Brewing. At these events, customers are given many opportunities to mingle with the company's employees as well as other customers. Participants of these events come to share the same values, and begin to bond as a group. Through repeated attendance at fan events, which are participatory in nature, ties can be strengthened as people start to remember each other's nicknames and faces. The company encourages customers and employees to build a friendly relationship, and this is reinforced by the practice of using nicknames. The company refers to such customers as "enthusiastic fans." Moreover, YOHO Brewing allows customers to have experiences that are usually only available to the company's employees. This leads customers to value even more this relationship with YOHO Brewing. These customers, now fans, share these positive feelings about the company with family and friends. Sometimes fans offer constructive criticism, and eventually become evangelists, exhibiting the highest level of brand loyalty.

As part of the process for raising recognition of the YOHO Brewing brand, the company puts a priority on the hosting of participatory promotional events, the kind of events that customers would be eager to share on their social media. For example, the company released the limited-edition beer Boku Biiru Kimi Biiru ("For You and Me Beer") to Lawson's convenience store chain, yeasty beer with a taste of lemon, lemongrass and coriander, targets younger customers. The beer can feature an illustration of a frog. YOHO Brewing then sent out promotional notifications on Twitter, "Operation for Catching a Frog" (Kaeru Hokaku Daisakusen). Whenever someone would buy this product at Lawson's, a photo of the beer would be taken as evidence that the buyer had succeeded in "catching a frog." The plan called for an announcement to be made on Twitter. At night, the company hosted the live streaming of online "drinking parties." In the first four days after the product's launch, more than 2,500 tweets were sent to announce "a frog sighting" and identify the location of that sighting. On Twitter, "#Caught a frog" trended, creating quite a buzz. Sales of Boku Biiru Kimi Biiru ("For You and Me Beer") during that first week exceeded those of a limited-edition beer released by a leading competitor that was also sold exclusively at Lawson convenience stores.

YOHO Brewing offers tours of its breweries on Saturdays and Sundays during the summer. The company's employees serve as tour guides. Participants are people who like beer. (They don't necessarily have to be fans of YOHO Brewing.) During the tour, participants are able to develop a deeper understanding about craft beers. They learn about YOHO Brewing's mission, and spend time with the company's employees, who share their thoughts and feelings. About 3,000 people visit YOHO's breweries each year.

The fan events help the company strengthen ties with existing fans. Such events are also useful in helping the company to reach potential customers, and develop stronger relationships with them. Taking the Yona Yona Ale Super Party as an example, 50% of participants heard about the event through the company's own media such as the email newsletter, social media, and the company's website, according to a company survey. It is clear that they are fans who have already established communication with YOHO Brewing. However, 30% heard about the upcoming event through word of mouth from friends and acquaintances. Fans who think that the Super Party will be fun bring their friends along. In this way, YOHO Brewing is able to expand its fan base.

The final stage is giving fans access to the types of experiences that are usually limited to the company's staff. YOHO Brewing invites fans to a meeting with the company's employees, during which all participants brainstorm together about the company's future. In 2018, YOHO Brewing shared its medium-term management plan with its fans. Together, they thought about YOHO Brewing's future. This special event was called, "Yona Yona Kore Kara Kaigi," (lit. "A meeting about Yona Yona's future"). YOHO Brewing selected as participants individuals who had prepared proposals about the types of things they would like to do together with YOHO Brewing, rather than those who had a list of things they wanted from the company. The discussion lasted for 3.5 hours. (No alcohol was served at this meeting.)

◆ CommunicationsYOHO Brewing's communications focus primarily on ways to increase customer loyalty. This is positioned as a higher priority than boosting short-term sales or securing profits. The company frequently creates campaigns and hosts events to improve customer engagement, and these measures have produced the anticipated results. Customers have not only continued making repeat purchases over the long term, but have also recommended the company's products to everyone around them. YOHO Brewing continues to implement a variety of initiatives on an ongoing basis, not only fan events aimed at increasing the number of passionate fans.

In addition, YOHO Brewing's own e-commerce site has a regular members' service, which has been bundled as a package set with the company newsletter. Other initiatives include introducing the company's activities on the e-commerce site, Facebook, and Twitter. YOHO Brewing also shares comments from fans, demonstrating its commitment to facilitating two-way communication with fans.

◆ Customer serviceYOHO Brewing has outsourced standard operational duties like order taking and order processing to an outside service provider (an external "partner company," according to YOHO Brewing). In contrast, the duty of responding to customer inquiries has been kept in-house, and is undertaken by the company's staff. Normally, a company's Customer Service Department would be responsible for providing an efficient response to inquiries, maintaining a uniform level of quality and following the guidelines set out in the company's manual. YOHO Brewing, with its extremely customer-centric corporate culture, is completely different. The company is so customer-centric that it encourages its employees to provide a response that far exceeds the customers' expectations even if doing so reduces efficiency or would contradict the company guidelines that appear in manual. Employees are always eager to please customers. The company aims to build ongoing relationships with customers that will continue long into the future. It is for this reason that employees are encouraged to continually exceed the customers' expectations.

To realize this goal, YOHO Brewing changed the leading key performance indicator (KPI) from the generally used cost-related indicators to the amount of enthusiasm demonstrated when responding to customers. Simultaneously, the company has embraced the concept of being "extremely customer-centric" as a shared corporate value. In recent years, YOHO Brewing has gotten more than 400 responses annually to its customer service that have been recognized by the company as a "Wow!" For instance, a customer affiliated with the Japanese Antarctic Research Expedition mentioned in passing the need to discontinue his annual subscription, the reason for this being a work assignment in Antarctica. The company's staff member heard about this, and instead of sending notification of a "breach of contract," that person confirmed the customer's date of departure for Antarctica. That staff member then traveled all the way from the company's office in Nagano Prefecture to Tokyo's Narita Airport to give this craft beer fan, who was readying for his departure to a distant new world, "a yell of support" and a send-off with Yona Yona Ale.

◆ Human resource managementAt YOHO Brewing, employees must be able to work with a high degree of autonomy. Regardless of their job assignment, every person must be aware of the issues that the company is facing, and be willing to take the initiative to start up projects that can be shared across departments. The company calls this type of approach a "project-focused system." Employees spend 20% of this time working on such projects.

Staff members are encouraged to first think for themselves, and then take action. The company holds a "team-building program" once a year to help employees learn how to more effectively produce results as a team. This training is held during working hours, and employees sign up for this training program on their own initiative. Over the course of this five-day program, participants learn team-building techniques that they can then take back to their own teams. In recent years, the company has added an advanced program, as well as a less intensive program. The latter, developed for new recruits and part-time staff, includes content that is more easily accessible and more casual. As a result, more than 80% of the staff have completed one of these three team-building training programs.

YOHO Brewing hires individuals from a wide variety of fields, and the result is a diverse workforce. YOHO Brewing's headquarters and brewery are located in Nagano Prefecture. However, 80% of the full-time staff come from outside the prefecture. The company will hire new recruits straight out of school, whether they have studied the arts or the sciences. The new hires can have a bachelor's or a doctorate degree. Mid-career hires can have a career in the civil service, an HR-related service industry, or in the telecommunications industry, for example. The conditions for employment include dedication to the company's management philosophy.

After joining the company, the new employee, regardless of whether being a new recruit right out of school or a mid-career hire, will spend the first month undergoing a period of orientation. These newcomers will receive in-depth instruction about the company's management philosophy and corporate culture. The training process includes problem-solving exercises related to actual business operations. During the problem-solving exercises, the new employees practice the aforementioned team-building skills and management of the Project System. YOHO Brewing aims to provide these newcomers with a true immersion in the company's corporate culture.

The average age of YOHO Brewing employees is 33 years of age, and employees are given the opportunity to serve as the leader of a company-wide project while they are still young. Regarding promotions to a managerial position like director, the company has adopted a "Director Candidacy System." Under this system, a presentation meeting is held once a year, during which the candidates for the director positions make presentations to the entire staff, explaining the details of the strategies and business plans they have drafted. The unit directors are then chosen, taking into account the employees' evaluations of each presentation and candidate. Anyone can become a candidate, except for the new recruits straight out of school, who must complete on-the-job training during their first year.

The company's employees are encouraged to work with flexibility. This means that they can freely rearrange their work schedules if they need to take care of some personal business. They will not have to provide any kind of explanation. This flexible work system cannot function effectively without good communication and trust among team members. Therefore, measures are in place to increase opportunities for active communication on a daily basis. (Please refer to the items included in the Organization and Corporate Climate section appearing below.)

All eligible employees have used their maternity leave, and the return rate after childbirth was also 100%. The rate of male employees taking paternity leave for child care was 66% (FY2019). YOHO Brewing has placed on the "Great Place to Work" list of Best Companies in terms of job satisfaction for four straight years, from 2017 through 2020. Among medium-sized companies (with 100 to 999 employees), YOHO Brewing ranked 27th in FY2020. (*14)

(*14) Great Place to Work Institute Japan's website. https://hatarakigai.info/ranking/japan/2020.html (Last accessed on Nov. 25, 2020.)

◆ Organization and corporate climateYOHO Brewing continually undertakes projects that require creativity, and employees must be able to fully express their personalities. Moreover, there must be ample opportunities for quality discussions. To support these objectives, the company has adopted a flat corporate structure. In terms of organizational design, the company has made utmost efforts to eliminate layers. The end result is an organizational structure with only three levels: President, directors, and team members.

With regard to the corporate climate, the company has developed and implemented a variety of communication policies that are required in order to support the smooth operation of a flat organization. YOHO Brewing has introduced a "Nickname System." Employees call each other by their nicknames, regardless of their positions, and the company's President Naoyuki Ide is called, "Tencho" ("Shop manager").

The company holds a 30-minute meeting each morning, during which employees get a chance to discuss topics unrelated to work. The objective is to foster mutual understanding and confirm the psychological well-being of the entire staff. This meeting is attended by all employees, including the president, the directors, and the part-time staff. Each person is given the chance to talk about anything they'd like, so long as it is not a work-related topic. The deepening of mutual understanding helps ensure that a frank exchange of opinions can take place in the workplace, and that communication will not be hindered by a person's position relative to others, or differences in personal experience.

YOHO Brewing is able to stimulate communication among employees through a variety of measures relating to all aspects of the business. In this way, the company has been able to create a culture in which people can comfortably speak their minds. YOHO Brewing views this flat organization as the most appropriate foundation for successfully developing unique beer products and offering customers ways to enjoy beer.

Innovations That Enabled Strategy

- Fan events that fuel enthusiasm and fall outside the scope of profitability. The company has established an internal department that is responsible for planning and hosting fan events. The company handles nearly every part of this process, from planning to actual implementation. It is very unusual for a manufacturer to maintain this kind of department as an internal function within the company, and is consistent with YOHO Brewing's highest corporate values: "Fun & Fans."

- Products that ooze personality, created with deep insight.

- Innovative and playful package design and naming that goes against the customs and conventions of the beer industry.

- The company has intentionally adopted a flat organizational structure, with only three levels. The corporate culture and communication policies support the company's flat organization. Practices that support the kind of corporate culture that thrives in a flat organization: A casual, daily morning meetings with the entire staff; the use of nicknames; training sessions that focus on team building; encouraging employees to take initiative (i.e., the company's "try your hand at making your own craft beer system," and the emphasis on building long-term relationships with customers).

- Outsources the production of its three main beer products to Kirin Beer, its competitor.

Trade-offs

- Does not make products that target the mass market segment. Aims to create enthusiastic fans. Makes products that target a niche, (i.e., supplies the kind of products that will strongly appeal to one person out of 100). Prioritizes communication and the development of long-term relationships with customers over short-term sales and profits.

- Foregoes the efficiency afforded by outsourcing the planning and implementation of fan events to an agency. Works to come up with the type of innovative plans that an agency would hesitate to even propose. (Entrusts the employees with this task.) Makes employees responsible for this work, which helps to raise their morale, and enhances the quality of interaction between employees and fans.

- Has gotten rid of the speedy decision-making process of a regimented pyramid organization, enabling employees to focus on innovation through teamwork. Adopted a flat organizational structure, which has permeated the corporate culture, allowing for open and direct communication. Encourages all employees to think for themselves and take the initiative. Revolutionizing the "thinking" (or mindset) within an organization requires much time and energy, and therefore is not easily imitated.

- Does not hire anyone who is not dedicated to the company's management philosophy. Due to the flat organizational structure, it is imperative that everyone share a dedication to the management philosophy.

- Does not own the facilities and equipment required for large-scale commercial production and the establishment of a sales network. Does not invest in an industrial brewing plant for large-scale commercial production. (The production of nearly all of YOHO Brewing's leading products have been subcontracted to Kirin Beer.) Outsources the operation of the eight beer restaurants (the "Yona Yona Beer Works"), all located in central Tokyo, to Wondertable, Ltd. Turned over all aspects of the restaurants' operations to Wondertable (everything from store ownership to store operation, and even the trademark). Loses freedom with regard to restaurant operations, and runs the risk of damage to its brand; however, avoids having to make extensive investments, and can fully concentrate management resources in its area of expertise. Minimizes risks associated with outsourcing because the company: (1) puts all of its efforts into realizing effective teamwork with its business partners; and (2) builds trust and strong relationships with external partner companies.

- Does not build a uniform, nationwide sales structure. Instead, raises brand recognition for its products nationwide by concentrating its operations in Karuizawa, a mountain resort in Nagano Prefecture. Sells the local brands Karuizawa Kogen Beer and Karuizawa Beer "Craft Zaurusu" (which features an illustration of a wooly mammoth on the can). Established a sales department that concentrates on the Karuizawa sales territory. Furthermore, focuses its sales activities on Tsuruya, the top local supermarket chain in Karuizawa. (YOHO Brewing's products are prominently displayed inside the store. According to a company survey, YOHO Brewing's products account for a 66% share of the Karuizawa market. This makes a strong impression on tourists visiting from Tokyo. Some of those tourists arrange for regular deliveries of the company's products.)

Consistency of Strategy over Time

YOHO Brewing's corporate mission is giving "Flavor to beer and Happiness to life!" To realize this mission, the company has defined its business domain not as "the production and sale of beer," but as "a beer-centered entertainment business." Furthermore, the company has been continuously implementing and strengthening the two core themes of its strategy over the past 16 years, since 2004: (1) Pursue extreme customer-centricity; and (2) create a unique corporate culture.

The prototype for YOHO Brewing's extreme customer-centricity was introduced in 2004, the year that the company commenced online sales of its craft beer products. When the "ji-biru boom" came to an end, the company fell on hard times. The email newsletter was YOHO Brewing's only point of contact with its customers. The company began writing articles about interesting but unimportant topics, completely unrelated to beer and sales promotion. Such topics included "private" topics that would normally be conducted only in a casual conversational style. Surprisingly, this elicited a strong response from the customers. YOHO Brewing saw this new development as a way to differentiate the company from its competition (i.e., the leading beer companies). Under normal circumstances, the major commercial beermakers would dominate the competition, owing to their overwhelming capital strength. However, there is a limit to what can be achieved by just supplying beer. That's when YOHO Brewing came up with the idea to focus on providing "entertainment" and bringing enjoyment to the lives of individual customers.

On the company's homepage, YOHO Brewing featured an article entitled, "A Sharply Contested General Election for Store Manager," along with a photo contest, "The Great Adventure of Yona Yona Ale." YOHO Brewing continues to generate ideas for this kind of unique web page content that is unrelated to business but has a high entertainment value. Company employees make sure that each customer comment receives an enthusiastic reply. It is a type of two-way communication. The sharing of interests and genuine communication is what enables the development of mutual understanding and provides insight into each other's personality. Consequently, there has been a steady increase in enthusiastic fans among the individuals who form the company's customer base.

In 2007, Rakuten, Japan's largest e-commerce platform, named YOHO Brewing "Rakuten's Shop of the Year (SOY)" for the first time. (YOHO Brewing has received this honor for 10 years straight.) Beginning in 2008, President Naoyuki Ide started attending the award ceremony in costume, and shared a live broadcast of the ceremony with customers. In this way, YOHO Brewing has been sharing real-time internet broadcasts with customers, to keep them involved in the company's unique activities.

From 2008, the company launched its team-building program (TBP). The objective was to help all company employees maximize customer value, not only those working in the online sales department. Participation is voluntary, and the training is intensive, spanning a three-month period. Those employees not participating in the program will have to take on the others' work responsibilities for that period. At the beginning, many employees resisted, objecting to the increased workload. However, the impact of this training was evident three years after the program's launch. More than 90 members of the staff have completed this training program, which has been offered for 10 years straight.

Also in 2008, YOHO Brewing set out its management philosophy, and introduced initiatives aimed at: (1) getting all employees on the same page with regard to the company's future direction; and (2) promoting common values. The company spelled out its future direction in its "Mission" and "Corporate Vision." Then, in 2010, the company announced its commitment to being "extremely customer-centric," adopting a flat organization, and encouraging employees to make their work "fun." This is the background regarding the establishment of the elements of YOHO Brewing's enduring corporate culture, known internally as the company's "Gaho Culture." (This is the shortened version−in Japanese−of the "Go for it! YOHO Culture"). In 2012, the company set out its "Values," which serve as a Code of Conduct for the entire staff. Then, in 2014, YOHO Brewing defined its "YOHO Value," the reason why customers support the company and its products. Since then, the company has been working repeatedly to promote the widespread acceptance of these concepts and this way of thinking within its organization.

In 2009, the company launched its first multidivisional project. YOHO Brewing came up with a plan to give customers the opportunity to experience first-hand the ingredients that are used in beer making. This marked the launch of "extremely customer-centric activities," conducted by teams of employees. Through this process it became apparent to everyone in the company how effective and important teams can be. In the fall of 2018, outside experts were brought in to upgrade the company's team-building program (TBP). The result was TBP1.5, and then TBP2.0. In this way, the team building program has been upgraded. The company has also developed a less intensive training program (TBP0.5). YOHO Brewing has been strengthening its efforts to help its staff members (everyone, regardless of whether they are executives, full-timers, or part-timers) gain a deeper understanding of the power of "the team."

In 2010, the Fan Event Planning Project was launched. The company provided a real (offline) event for fans. About 40 fans attended this first event, called the "Yona Yona Ale Party." Since then, the scale of this event has grown steadily over time. The company has been developing content, keeping in mind "Learning, Interactions, and Creativity," while following the PDCA (Plan, Do, Check, Act) Cycle, and taking into account employees' questionnaire results. By 2016, YOHO Brewing had hosted Fan Party events more than 10 times, with 40-80 participants attending each event. The Fan Party has become so popular in recent years that tickets have been selling out within minutes after going on sale.

Furthermore, the company has become increasingly involved with its many fans. In the spring of 2015, the company held its first "Yona Yona Ale Super Party, with 500 fans attending. Since then, the event has been held on an ongoing basis, and attendance has grown steadily. At the Fan Party held in Spring 2016, there were 1,000 fans, followed by 4,000 at the Fall 2017 event, and 5,000 at the Fall 2018 event. In Spring 2019, 1,000 fans attended. Large-scale events were also planned for Fall 2019, with 10,000 fans expected and Spring 2020 with 20,000 fans, but these plans were cancelled, the first due to a major typhoon, and the second because of the outbreak of the Novel Coronavirus (COVID-19). More than 60% of the company's staff have volunteered to take part in each event. This fan parties not only provided an opportunity for interaction; everyone is finally able to put names with faces. In order to bolster these initiatives, YOHO Brewing has established a new Fan Event Department, tasked with developing satisfying contents for its customers.

In addition to hosting real (offline) events for customers, the company began hosting an online drinking event called "Yona Yona Ale Night" in Fall 2015. This event has been held 35 times, and is not a regularly scheduled event. Online events offer the opportunity for two-way communication. The company hosted the "At Home Super Party" in May and June of 2020. This event, spread over two days, was attended by a cumulative total of 10,000 fans.

As a result of these various initiatives aimed at deepening relationships with fans, the company's fans have started hosting the "Fan Party," "Super Fan Party," and "Ultra Party" events at several locations in Japan.

In 2018, fans were invited to take part in a discussion regarding YOHO Brewing's medium-term business strategy and the company's future. This event was called, "A Discussion about the Future of YOHO Brewing."

What all these events have in common is an intentional disregard for short-term profitability. The company ends up overspending for each of these events. However, the impact of these small interactions and the steady business growth achieved over the long-term reinforces the company's conviction that "raising customer satisfaction is indispensable to realizing business growth in the medium term." It took time to see clearly this cause-and-effect relationship. It is precisely for this reason that the company's overwhelming commitment to its customers, which cannot be imitated by competitors, so effectively attracts new fans. YOHO Brewing has gained a reputation for being among the few Japanese companies known for having passionate fans.

Profitability

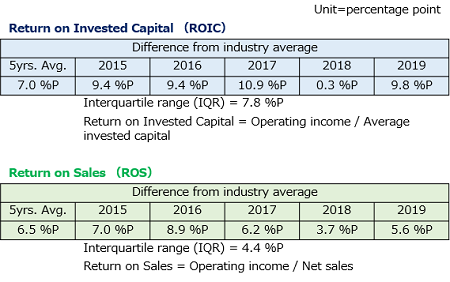

YOHO Brewing Company's five-year averages for return on invested capital (ROIC) and the return on sales (ROS) exceed the industry average. (Profitability analysis was conducted by PwC Japan.)

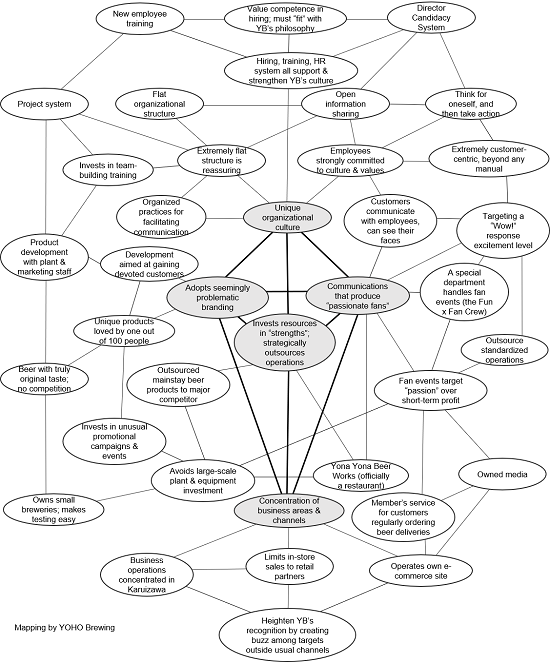

Activity System Map of YOHO Brewing Companye

Winners PDF

- 2020 Winners Pdf (All of the award company in this year are published. )